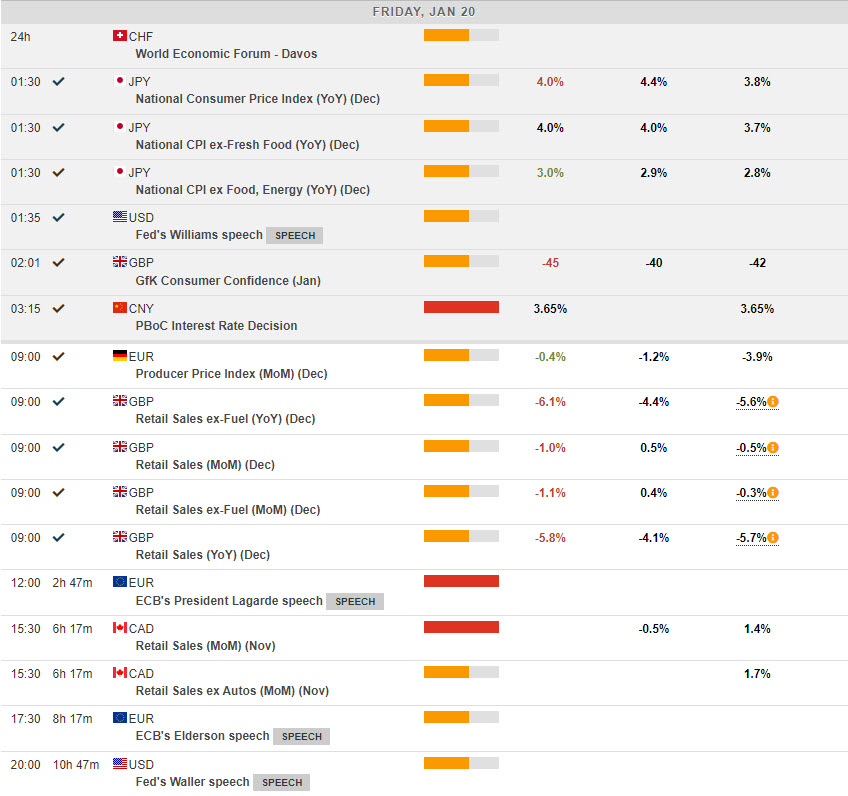

Better US data (Unemployment Claims & Philly Fed Manu Index) could not lift the USD (USDIndex under 102.00) & Wall St. (-0.76% to -0.96%). US hit its latest debt ceiling ($31.4 trillion) as Republicans try to rein in Biden’s spending. Potential default postponed until June 5. More Hawkish comments from FED speakers (even key Dove Vice Chair Brainard) talking 5.00%+ terminal rates failed to rally USD. Bonds picked up, the US 10-yr yield dropped to 3.41%. Asia markets are higher ahead of Lunar New Year holidays with the huge Chinese population on the move and all the risks that that entails. Inflation in Japan hit a 41-yr high at 4.0% and the PBOC held rates at 3.65%. NETFLIX shares (-3.23%) rallied +7.12% after hours after subscriber numbers beat and CEO Hastings stepped down and moves to Chair.

- The USD Index rallied from 7.5 mth lows at 101.25, on Wednesday, held 101.70 yesterday but continues to break above the 102.00 handle.

- EUR – holds at 1.0825 now, having tested below 1.0800 yesterday, following a new 8-mth high over 1.0880 this week.

- JPY – Bounced from sub 128.00 lows at 127.80 and trades north of 129.00 following Japanese inflation data. Yen is the weakest of the G7 currencies today.

- GBP – Sterling was unable to hold the breach of 1.2400, this week but holds its bid at 1.2330 today. UK Consumer Confidence and December Retail Sales both missed significantly. BOE Governor Bailey put a positive spin on a possible quick decline in Uk inflation.

- Stocks – The US markets were weak again yesterday (-0.76% to -0.96%). US500 -0.76%, breached the key 3900 support, the 50 SMA & test the 20 SMA) to close at 3898. US500 FUTS hold 3900 at 3924.

- USOil – plunged to post the low of the week at $78.41 before inventories data showed a build of 8.4 million barrels (vs. an expected drawdown of 2.4 million barrels) and prices rallied to $81.50 and holds at $81.00 now.

- Gold – has hit 9-mth highs today at $1935 again today and trades at $1930 now. The spectre of CB’s reluctant to talk pivot and season factors help the key commodity.

- BTC – Continues to hold the $20k handle this week and is back to test $21k today.

Today – US Existing Home Sales, Speeches from ECB’s Lagarde & Elderson. Earnings – Ericsson (beat) Final day of WEF in Davos.

Biggest FX Mover @ (07:30 GMT) AUDJPY (+0.21%). Rallied from a 400 pips reversal yesterday down to 88.00 to trade at 89.35 now. MAs aligned higher, MACD histogram & signal line positive & rising. RSI 22.87, OS & falling, H1 ATR 0.239, Daily ATR 1.278.

Click here to access our Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.