The Dollar continues to retreat on the back of Chair Powell’s speech & ahead of US CPI data this week

Dollar

The Dollar finds itself bouncing off a 7-month low midweek, on the back of an important speech by FED chair Jerome Powell. The speech failed to inspire bullish impetus, mainly because it lacked any clear direction for the US central bank’s next moves concerning its stance on interest rate decisions. The main takeaway from the comments made were centred mostly around complementing and doubling down on the FED’s moves in the past year in their fight against stubborn and record-high inflation. Going into the remainder of the week, US inflation data will be in the spotlight, and investors are waiting with bated breath as the ever present theme of a looming recession and the FED’s inability to lean towards a bearish bias keeps potential bulls optimistic ahead of the key CPI release on Thursday, which will give the US currency short term directional impetus. CPI is expected to have risen by 0.3% in December, and the final figure will influence the size of the Fed’s next interest rate increase.

Technical Analysis (D1)

In terms of market structure, price has come to a significant juncture and rests around the key 103.01 where the previous higher-low was formed. The nuance to be noted, however, is that price is approaching this area in a corrective nature in the form of a descending channel which could turn out to be a potential reversal pattern. If bulls can defend this area, the narrative could still remain bullish for the long term, however the opposite applies if the area is invalidated by sellers.

Euro

The Euro retained some of the momentum and optimism seen since late December, as it adds to its gains for a fourth consecutive session. However, further upside momentum seems to be potentially capped by the cautious approach traders take ahead of a key economic data release in the form of the US CPI data due on Thursday. While inflation risks remain top of the agenda, some bullish impetus could potentially be gained on the back of comments from the ECB’s board members Villeroy and Holzman, who have essentially advocated for the continuation of the hawkish stance the central bank has recently had, which would see a prolongation of the tightening cycle. Looking ahead, Dollar dynamics will strongly influence the directional bias of the European common currency, and the impact of the current energy crisis as well as the divergence between the ECB and the FED.

Technical Analysis (D1)

In terms of market structure, price has invalidated the longer-term downtrend formed from mid-May 2022 and has done so in an impulsive break of structure. Since then, the bulls have been driving price, creating higher-highs and higher-lows. Current price has bounced off a key level in the 1.0700 area, and if defended by the bears, price could potentially reverse. Conversely if the bulls can sustain the pressure, price could break above the level.

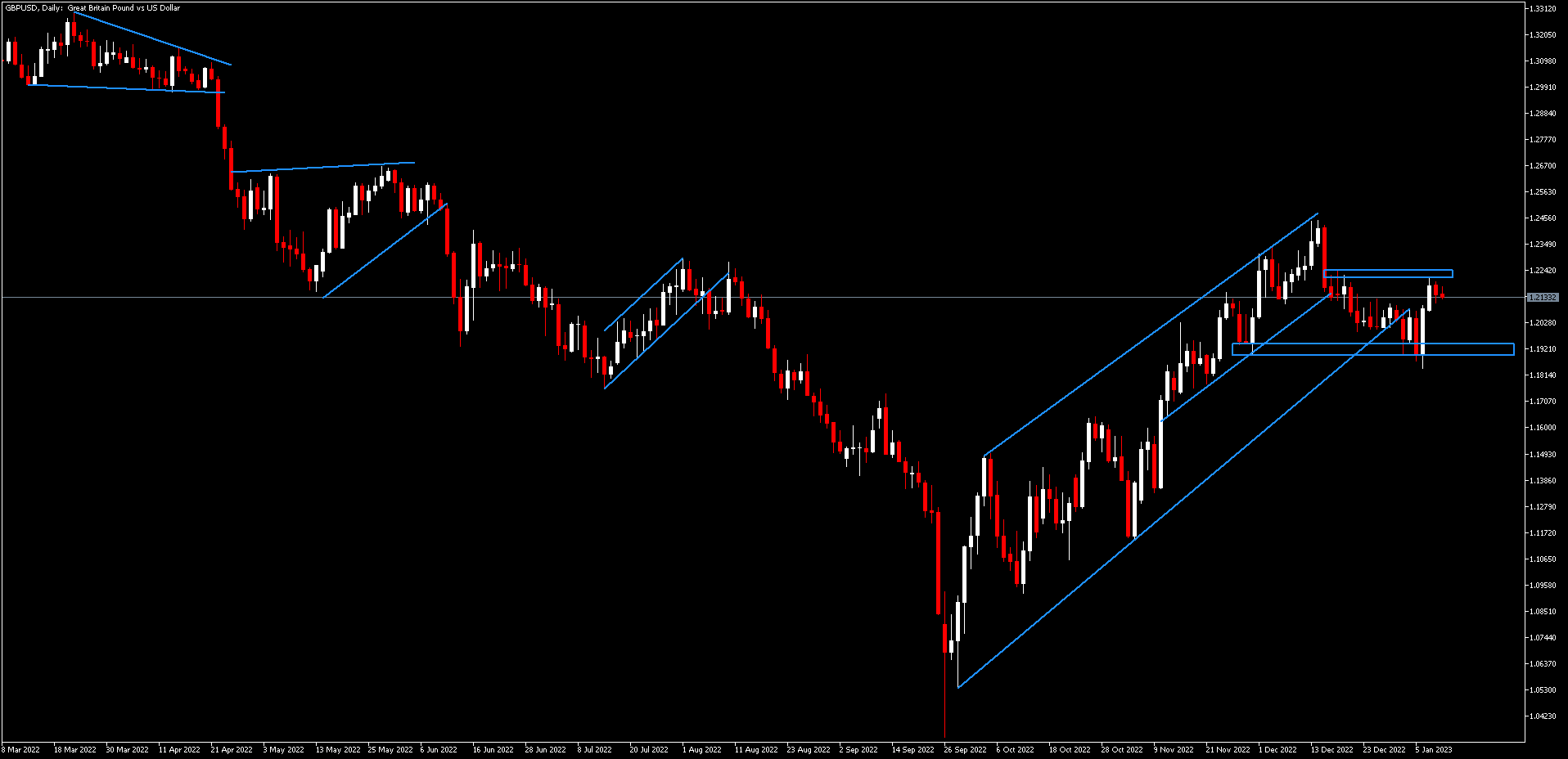

Pound

Sterling began the week pulling back from a 3-week high and now rests above a key support level located at the 1.2100 level. Factors driving this exuberance can be attributed to the improved risk sentiment in the market ahead of the key US CPI data release on Thursday. However, further upside momentum is likely to be muted by the fact that market participants are likely to wait on the much-anticipated CPI data to determine if the trade has further upside potential. Looking ahead, Sterling could face a significant hurdle, driven by the bleak outlook of the UK economy, which is adding conjecture that the Bank of England is nearing the end of its current interest rate hiking cycle.

Technical Analysis (D1)

In terms of market structure, the bulls have been in control of the narrative and price has tested the key 1.2450 level and has since pulled back. The nuance to note at this juncture is the corrective nature of the approach to the area in the form of an ascending channel, which means price is coming under pressure as sellers enter the market and buyers take their profit off the table. If the area is defended it will result in the reversal pattern being validated. Conversely, if buyers break above the area, price will continue to remain bullish in the near term.

Gold

Gold heads into the new week on the front foot, as prices keep rising for the fourth consecutive day, hitting the highest level since May 2022 around the $1,891 level. Factors driving this exuberance can be attributed to Dollar weakness, as well as rumours that the People’s Bank of China (PBOC) will potentially announce significant rate cuts in 2023, which will fuel the price of the yellow metal due to the fact that China is one of the world’s leading consumers of Gold. Looking ahead, market participants will be eyeing the much-anticipated US CPI data due on Thursday, which could lend some impetus to the bulls to hit the $2,000 level if the inflation data is softer than expected.

Technical Analysis (D1)

In terms of market structure, Gold has broken out of the outer trendline on the downtrend, and since then, bulls have been in control of price. Currently price action has reached a significant resistance at the $1,891 area in the form of a potential reversal pattern (rising channel). If sellers can defend this area it will confirm the reversal pattern, however if buyers maintain their interest, price could break above and remain bullish towards the $2,000 level.

Click here to access our Economic Calendar

Ofentse Waisi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.