Want to “supercharge” your trading results? Of course, you do! Well, read on because today’s lesson is a power-packed price action trading tutorial that is going to give you some solid, actionable strategies that you can begin implementing immediately to help improve your trading results.

Want to “supercharge” your trading results? Of course, you do! Well, read on because today’s lesson is a power-packed price action trading tutorial that is going to give you some solid, actionable strategies that you can begin implementing immediately to help improve your trading results.

The ‘tricks’ that follow are essentially some of the strategies in my trading ‘war chest’; the same techniques that I use on a weekly basis to find high-probability entries into the market. I’ve written about some of these over the years on this blog and in our members’ area, but I wanted to give you a quick summary of my favorite tips and tweaks that I use to enhance my overall R return. As you may know, I measure my returns in R (R = unit of Risk) and not percentages. For me, everything comes down to how many R’s I have risked vs. how many R’s I have returned. To learn more about this, check out my lesson on risk reward and money management.

Here are my 3 favorite trading tricks that significantly increase my chances of returning more R’s per trade…

Second-chance entries of major signals or breakouts

Often, a nice signal will form, and for whatever reason we will miss the initial entry. In this case, you don’t have to panic or ‘chase’ the market, because most of the time there is an opportunity for a second chance trade entry. You just have to be patient.

The idea is that a market will often retrace to an area it broke out from or to the area of a strong price action signal, at least once after the initial move, often it will retrace back to it more than once.

We can implement this strategy by simply waiting for price to retrace back to where an obvious price action signal formed or to an area of a strong breakout level or event area. Then, once price has retraced back to that area, you just enter in the original direction of the move.

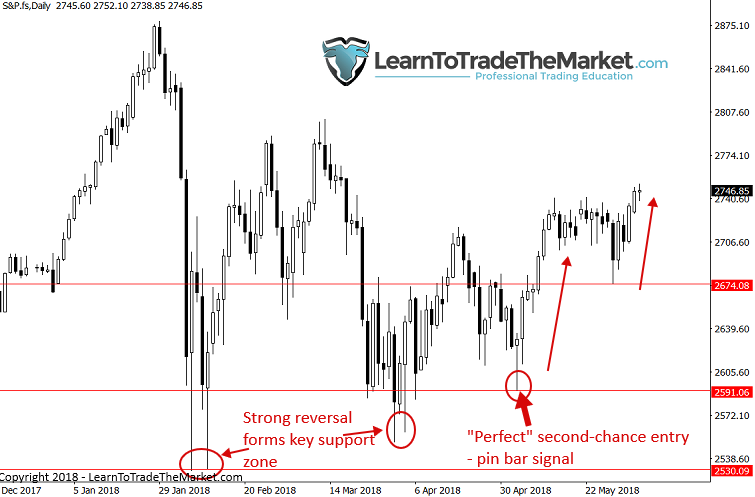

Here’s an example:

In this case, the S&P500 had carved out an obvious support zone / event area down near 2590 – 2530. When the pin bar signal that is circled on the chart below formed, it was a second-chance (and an obvious one) to get in on the impending upward surge…

In the next example chart below, we see a clear AUDUSD pin bar reversal formed at a very strong resistance level. Now, I will be the first to notice that at the time, this would have been a somewhat hard trade to enter short because it was counter-trend. But, the market followed through lower and then it retraced back up to where the first pin bar formed and formed another pin bar, giving you that obvious second-chance entry to sell again…

In the last example chart above, you could have entered with a stop loss above the first pin bar reversal high and gotten a very good risk reward ratio potential if you entered on that retrace of the pin bar’s tail. This can greatly increase the potential R return of a trade since your stop loss is tight and there’s big potential for a strong move if you are not stopped out. You can see what happened above. Note: you certainly do not have to use or try to get a ‘tight’ / small stop loss on these second-chance entries, a wider stop loss is also fine and in fact a wider stop will often allow you to stay in the trade longer and lowers the chance of an early shake-out / stop-out before the market moves in your favor. You will get better at stop loss placement through education, time and practice.

50% entries of signals and swings

I personally LOVE 50% entries both of price action signals (mainly pin bars) and entering after a 50% retrace of a major market swing…

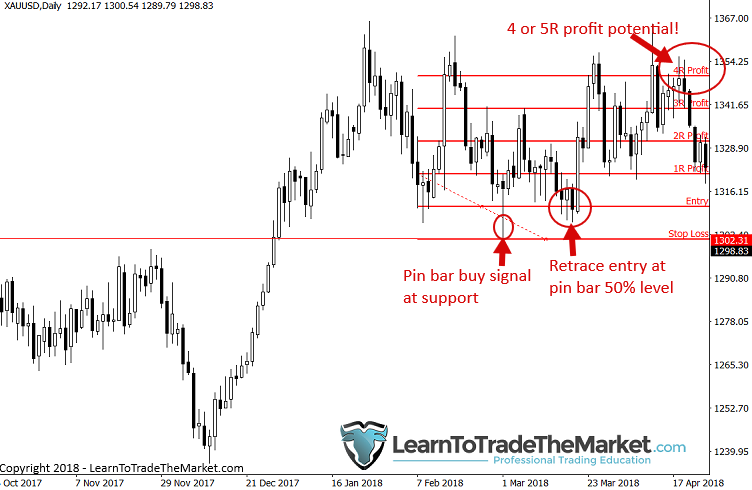

A 50% pin bar entry is something I often call a “pin bar tweaked entry” wherein you typically set a limit order at a pin bar’s 50% level. Often, price will retrace to the pin bar 50% level, especially on longer-tailed pins. This gets you in with a very tight / small stop loss and thus greatly increases the Risk vs. Reward potential of the trade. You can learn more about this entry technique in an article I wrote called The Trade Entry Trick.

Here is an example of entering a recent Gold pin bar as it hit the 50% level of the pin bar. Note, it was almost two weeks later that price hit that level, but that doesn’t matter. What matters is patience and understanding these entry tweaks and waiting for them to happen…

There are entire books written on trading 50% retracements of major market swings. In fact, history shows that most market moves will retrace approximately 50% and then resume the original move direction. This is obviously a huge clue that we can use and look for.

In the example below, you will see two 50% retracements of down-moves in the AUDUSD. Both also had signal confluence, meaning a price action signal formed near the 50% level, giving you further confidence that a move back the other direction was coming…

Pyramiding – snowball profits in runaway trending markets

Note: This is only for advanced and experienced traders because it’s relatively difficult to implement properly and takes advanced knowledge and understanding of price action and market dynamics to pull off.

What I’m talking about is pyramiding into a position in a very strong / runaway trending market. This allows you to significantly increase the Reward potential of a trade and is truly the only way to properly make a lot of money in the market, fast.

I recently wrote an article that details with chart images how to trade a runaway trend, so be sure to check that out first.

But, the basic idea is that when you’re confident a market is moving aggressively in one direction, ideally after a significant signal or significant breakout, you can try pyramiding in by adding positions at strategic points. This will work to build a bigger position and IF the market keeps moving aggressively in one direction, you can make a nice chunk of change in a small amount of time. Of course, you must plan your exit strategy so that you don’t lose all that money if the market does keep moving in your favor!

You should only ever have 1R at risk even with this pyramiding strategy (you move previous positions to breakeven or lock in profit as the trade progresses in your favor), and normally you’d be aiming for 2R, but in a runaway trend where you’re pyramiding, that same 1R ‘seed’ can turn into 5R or even 10R rewards. Note, for larger positions there is a larger risk of gaps over the weekend; the market could gap against you, again this is another reason this strategy is for advanced traders only.

Confluence

Perhaps my favorite trading ‘trick’ that will definitely “supercharge” your trading results, is trading with confluence.

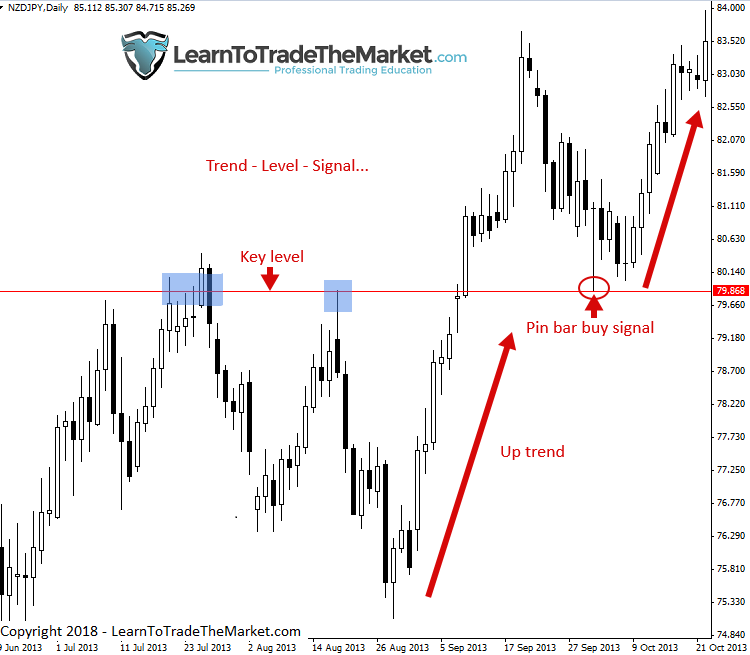

This means, we are looking for multiple supporting factors or pieces of evidence that agree for a trade. We are waiting for the ‘stars to align’ so to speak, to put the odds in our favor. Indeed, this is how trading success is born and how fortunes are made, and the central theme here is patience. You may have to wait weeks or months for the right Trend, Level and Signal to align, but when you get that T.L.S. alignment you know you have a very strong trade on your hands.

Now, let’s look at a few examples of different T.L.S. combos. You don’t always need all three, you can consider and take trades that have only a trend and a signal, for example. Just know that the more pieces of confluence that line up, the better. I expand in greater detail with many more chart examples of all the different pieces of confluence I look for in my price action trading course.

This example shows a nice pin bar signal that formed in-line with a strong trend. Notice it was a pin bar sell signal in the context of a downtrend after price had pulled back to the upside slightly, what I call “selling strength in a downtrend”:

The next example is showing how you can enter a trade with just a signal at a key level. This was a recent pin bar signal in the Dow Jones Index that formed at an obvious key support / event area. So, you had a clear / obvious signal at a clear / obvious level, the trend however, was not obvious, more of a sideways market, but this goes to show that 2 out of 3 can work sometimes:

- “The perfect storm” …

Finally, this is what I would call my “desert island” trading strategy; the trading strategy I would take to a desert island if I was marooned there for years (somehow with good wifi, lol) and could only pick one strategy.

This happens when we get a Trend, Level and Signal all lined up. You can have more pieces of confluence lining up too, like an EMA or 50% retrace swing point, etc. The more the better. But, when you get a T.L.S. line up, it’s time to stop thinking and start acting:

Conclusion

The trading ‘tricks’ and tweaks that you read about above have helped me enhance my profitability by giving me an edge in my trade entries and also by allowing me to increase the risk to reward ratio and snow-ball my returns per trade. You really must maximize your winners because honestly, good trades don’t really come around all too often. If you’re trading properly (being patient and disciplined, etc.) you are not going to be trading frequently, you’ll be trading with a low-frequency approach, so pay attention to the tips discussed above to try and maximize your winners.

Understand that I’m not using these approaches on every trade, but I am always on the lookout for them and looking for opportunities to apply them as I analyze the market on a day-to-day basis and look for trade setups at the end of the trading day.

Trading is truly like a war. It’s you vs. not just every other trader, but also you vs. you. You literally must have your ‘war chest’ full of different ‘weapons’ to help you increase your chances of winning and maximize your returns. The strategies discussed above, along with the concepts I teach in my advanced price action trading course, will give you everything you need to wage a successful fight in the markets and hopefully come out victorious.

What did you think of this lesson? Please share it with us in the comments below!