EURUSD, S&P 500, Fed Rates and Liquidity Talking Points:

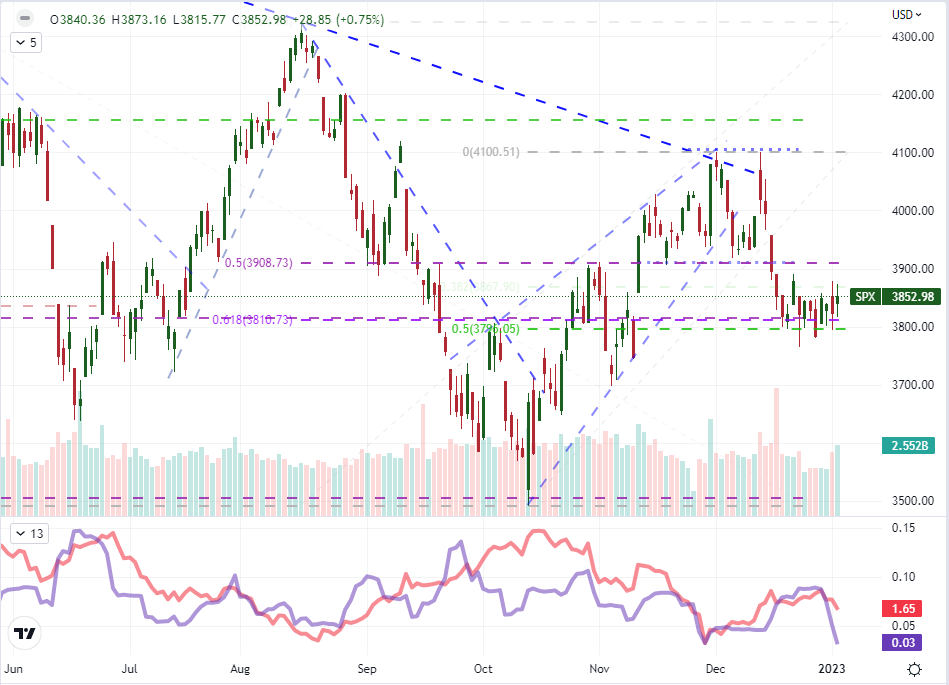

- The Market Perspective: S&P 500 Bullish Above 3,900

- The FOMC minutes reiterated the message of a critical inflation fight, more rate hikes ahead and no cuts forecasted for 2023; but the markets refuse to believe

- EURUSD’s breakdown reversed before the minutes were released, but they didn’t help. Ahead, the focus may shift back into growth concerns as we approach NFPs

Recommended by John Kicklighter

Building Confidence in Trading

Liquidity is still uneven across the global markets. While deeper markets do not ensure a clear fundamental course nor general conviction, it is a critical element to supporting such conditions. With only two full trading days under our belts for 2023, we have seen a steady rise in volume for benchmarks like US indices but there remains an inconsistency across the different risk-leaning assets for both committed direction and momentum. Volume and open interest are notoriously thin through the opening week of trading years – in part because it averages fractional weeks – but a strong fundamental charge can still offer a strong override on the inertia. We had the potential for interest rate speculation to regain its 2022 glory this past session, but the FOMC minutes wouldn’t break the market’s skepticism. Perhaps the upcoming event risk can unseat the discrepancy in rates view…or may spur another dominant theme: recession fears.

Nowhere was the combination of the problematic liquidity backdrop and discounted fundamental event risk more influential on the market than EURUSD. On Tuesday, the cross managed its biggest single-day drop in months, sheering through the floor of a remarkably narrow corridor. While that daily close below support qualifies as a break in my book, follow through requires a greater degree of commitment from the speculative rank. Without a clear fundamental theme to connect to nor a generalized speculative charge for the Dollar, the bearish jump needed another mode of support. There were a few light listings this past session, but neither the JOLTS job quits nor the FOMC minutes would inspire the markets. Ultimately, the labor data was supportive of the US economy while the Fed reiterated its message that inflation was the focus and they fully intended to push markets to a rate plateau above 5.00 percent. The Dollar seemed to generally overlook the news altogether with EURUSD sticking to its rebound and move back into the past weeks’ frustrating range.

| Change in | Longs | Shorts | OI |

| Daily | -19% | 22% | 2% |

| Weekly | 1% | 5% | 3% |

Chart of the EURUSD with 20 and 100-Day SMAs, 5-Day Historical Range (Daily)

Chart Created on Tradingview Platform

Within the policy forecast debate, there is an interesting quandary. The central bank maintains its view that further rate hikes are ahead, supports its December SEP forecast for a 5.1 percent benchmark rate in 2023 and has made it a point to reiterate its belief that no rate cuts will be realized this year. While Fed Funds futures have edged up slightly to see a peak rate on rates of approximately 5.00-5.25 percent, that crest is likely to recede. Further, the markets continue to price in rate cuts in the back half of 2023. For risk assets, I don’t see a benefit to that outcome. If the Fed continues to press forward with its peak rate and gets across to the markets that no cuts on in the cards, the market will have to reprice the financial restriction. Should the central bank have to cut against its own guidance, the circumstances would likely be worse, prompted by dire economic conditions. I don’t expect this scenario analysis to be mainstream and adjust imminently, so we await a more overt catalyst to move the S&P 500 out of its smallest 12-day trading range since November 2021.

| Change in | Longs | Shorts | OI |

| Daily | -10% | 10% | -2% |

| Weekly | -14% | 10% | -4% |

Chart of the S&P 500 with Volume, 12-Day Range and ATR (Daily)

Chart Created on Tradingview Platform

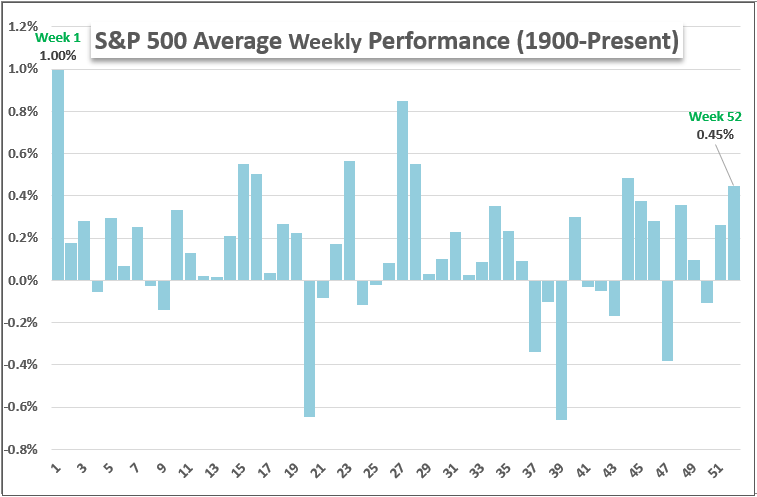

With the rebound in the S&P 500, we have thwarted any gain in bearish traction; but we are also simply lacking for any kind of progress in either direction. The slow recover in volume and temperate level of VIX through this opening week tend to align to these conditions. The contrast though remains with this performance and the seasonal expectations for performance for the underlying index. I will remind that historically, the S&P 500 averages its best week of the year through the opening stretch. Through Wednesday’s close, we are virtually unchanged from last week/month/year. While there is capacity for market movement in the upcoming event risk, its potential seems to skew to a greater threat that support.

Chart of S&P 500 Average Performance by Calendar Week Back to 1900 (Weekly)

Chart Created by John Kicklighter

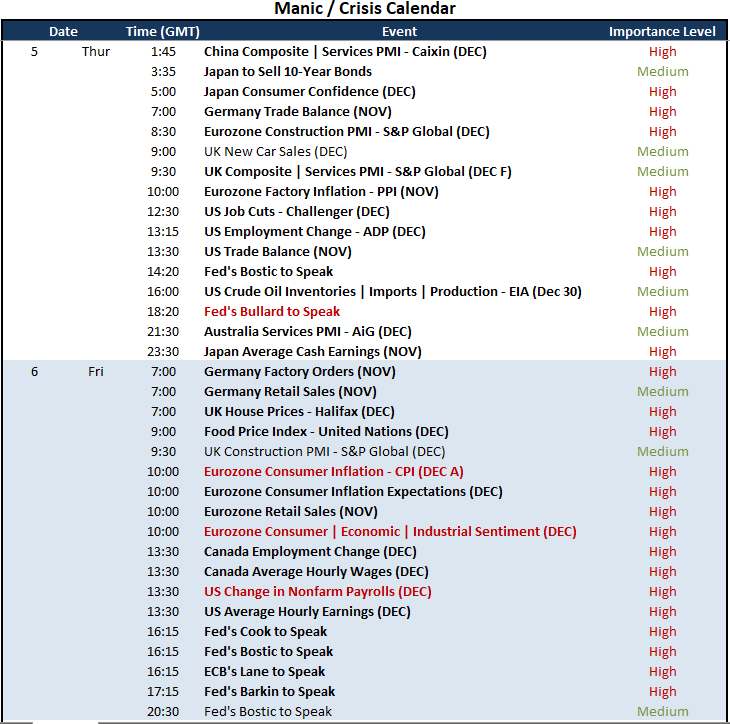

Taking a look at the economic docket, there is potential to dip into either/both the rate forecasts aspect of the market discussion and recession fears. On the former, Fed speak between Bullard and Bostic will offer potentially new and nuanced perspective on monetary policy forecasts. Given the market’s reticence to price in the central bank’s official forecasts, it will be important to see what tactics the Fed employs to adapt market expectations. If anything, I would put more emphasis on Bullard’s willingness to pull pins on message grenades. Between the two themes, it seems economic forecasting will be the more pressed upon theme. The docket Thursday has an emphasis on pre-NFP employment data, but the payrolls figure on Friday will be the bigger act. And it isn’t just the US we should be considering for recession watch. The IMF’s warning for ‘one third of the world’ facing a 2023 recession should have us monitoring all the important players including data such as the Chinese Caixin PMIs, Japanese consumer confidence survey, German trade balance and Eurozone construction activity report.

Top Macro Economic Event Risk Through Week’s End

Calendar Created by John Kicklighter

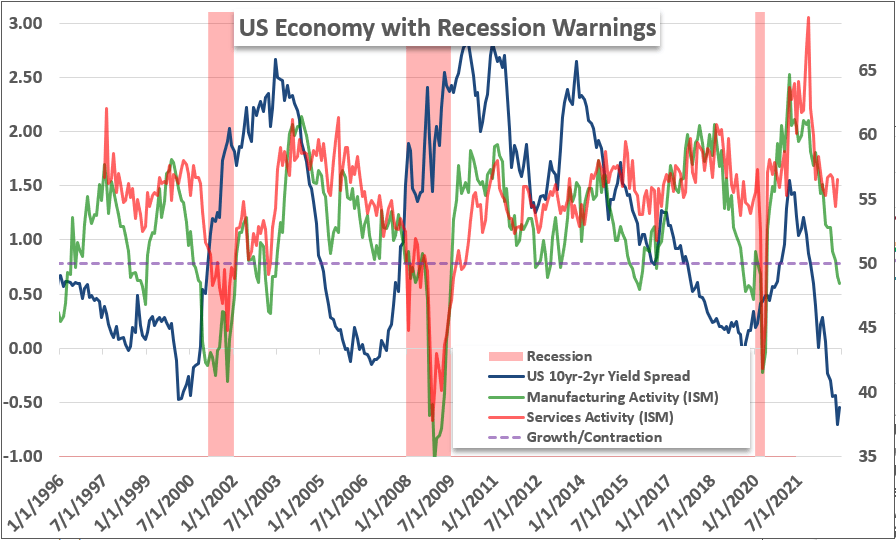

Speaking of recession measures, I have reiterated the US 2-10 spread (10-year minus 2-year Treasury yield) signal. This yield curve has been inverted for months, but we have yet to hear of an official ‘recession’ call. That is not a surprise as there is a delay between this measures inversion and an official call, but data may draw this threat into starker relief. In particular, I’ll be looking at the service sector activity report from the ISM on Friday afternoon given that the manufacturing report extended its slide into contractionary territory this past session.

Chart of S&P 500 Average Performance by Calendar Week Back to 1900 (Weekly)

Chart Created by John Kicklighter