US Dollar, EUR/USD Talking Points:

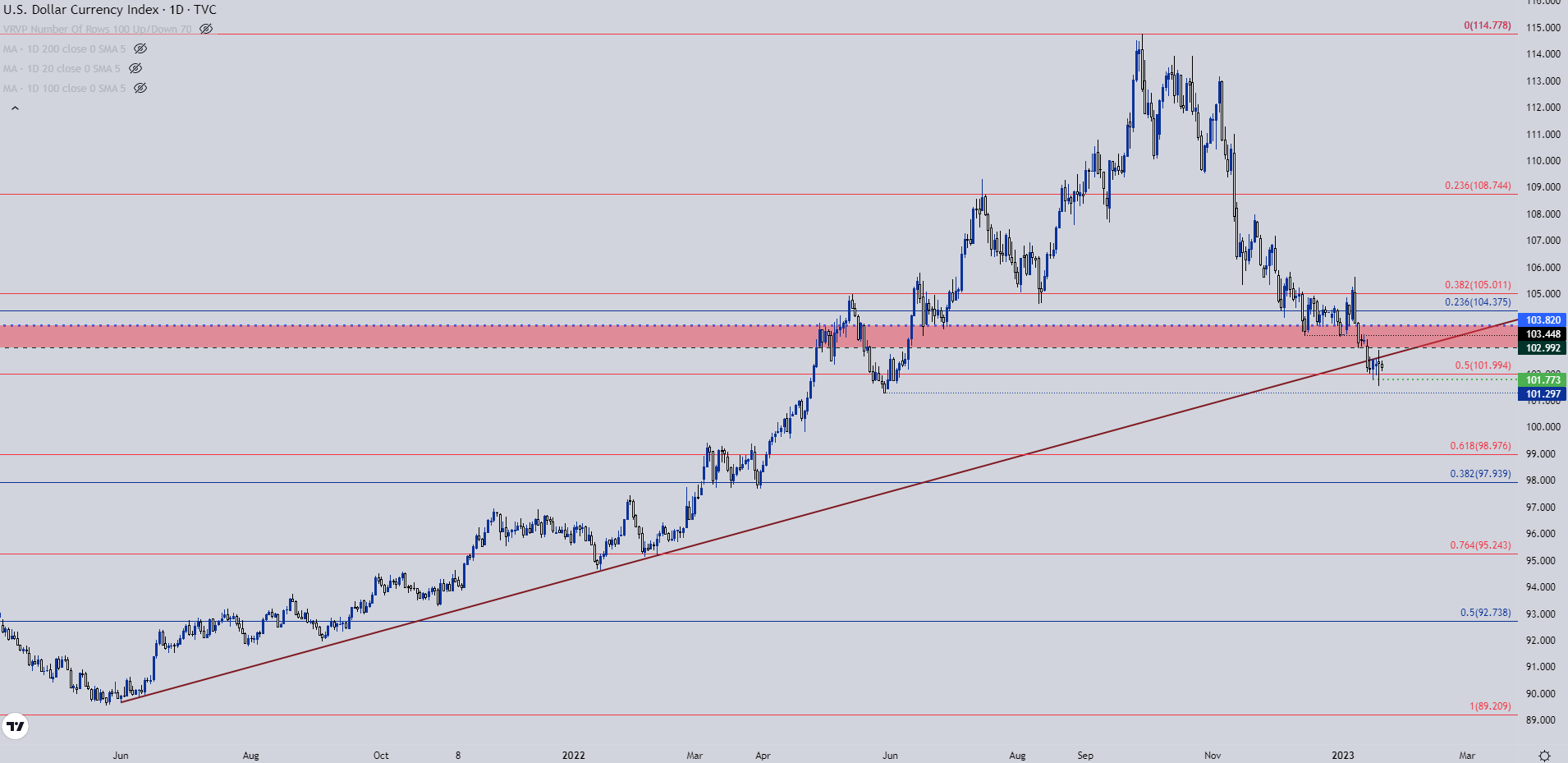

- US Dollar weakness continued to show yesterday as DXY printed a fresh seven-month-low; but buyers put in a response in the latter portion of the session leaving that daily candle as a doji.

- As USD has built a short-term range, so has EUR/USD. GBP/USD is testing above a longer-term Fibonacci level and USD/JPY is trying to set its footing after a busy start to the week.

- The analysis contained in article relies on price action and chart formations. To learn more about price action or chart patterns, check out our DailyFX Education section.

Recommended by James Stanley

Get Your Free USD Forecast

US Dollar bears have continued to punch and yesterday brought another fresh seven-month low into the mix after the release of PPI data earlier in the session. US data continues to slowdown, and this brings questions around the Fed’s rate hike plans. The US Dollar has been pricing this in since ahead of the Q4 open and more recently, the USD has been budging below some key spots of support.

Coming into the year there was the 103.45 level which held a couple of different inflections in the latter portion of December. But then a PMI report two Fridays ago knocked that theme over as sellers went on the prowl and price built a bearish engulf on the daily, which led to a continuation of that move through last week’s trade.

At this point, there’s a bit of support playing-in from the 50% mark of the 2021-2022 major move which plots at 101.99. This level has bent such as we saw yesterday but, as yet there hasn’t been a daily close below so we can say that the price has been respected to some degree. On the resistance side of the coin, we have the bullish trendline that held the lows from June of 2021 until being broken last week, which is sitting overhead.

US Dollar Daily Price Chart

Chart prepared by James Stanley; USD, DXY on Tradingview

EUR/USD

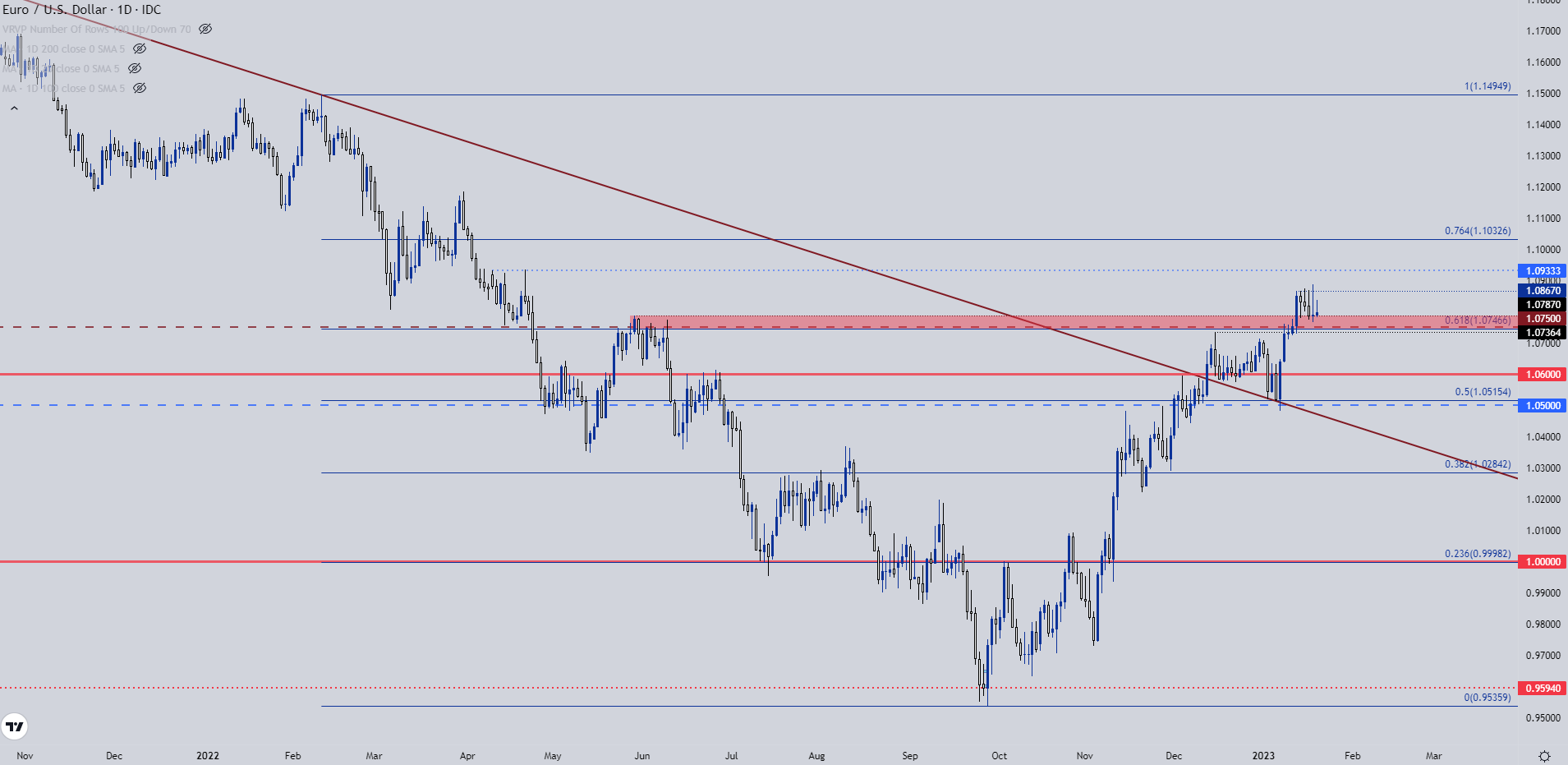

EUR/USD has been range-bound this week and there’s now been five consecutive days of resistance at the 1.0867 level that came in to mark the highs last Thursday.

Yesterday’s daily candle is particularly interesting as it closed as a doji, but also saw the high and low of the prior day tested through. So, there was an element of engulfing action for a doji formation; which indicates that trends may not be far off given that both buyers and sellers were willing to test above the high and low, respectively, even if finishing with indecision.

Bigger-picture, EUR/USD remains atop a key zone of support as taken from prior resistance. I’m tracking this down to the 1.0736 level and for reversal scenarios to come back into the picture, bears are going to need to take that level out, producing a fresh lower-low to give the appearance that bearish trends may be on the way back.

But, for now, that support zone has held at prior resistance and the next resistance level on the chart is the 1.0933 swing from last April’s double top formation.

Recommended by James Stanley

How to Trade EUR/USD

EUR/USD Daily Price Chart

Chart prepared by James Stanley; EURUSD on Tradingview

GBP/USD

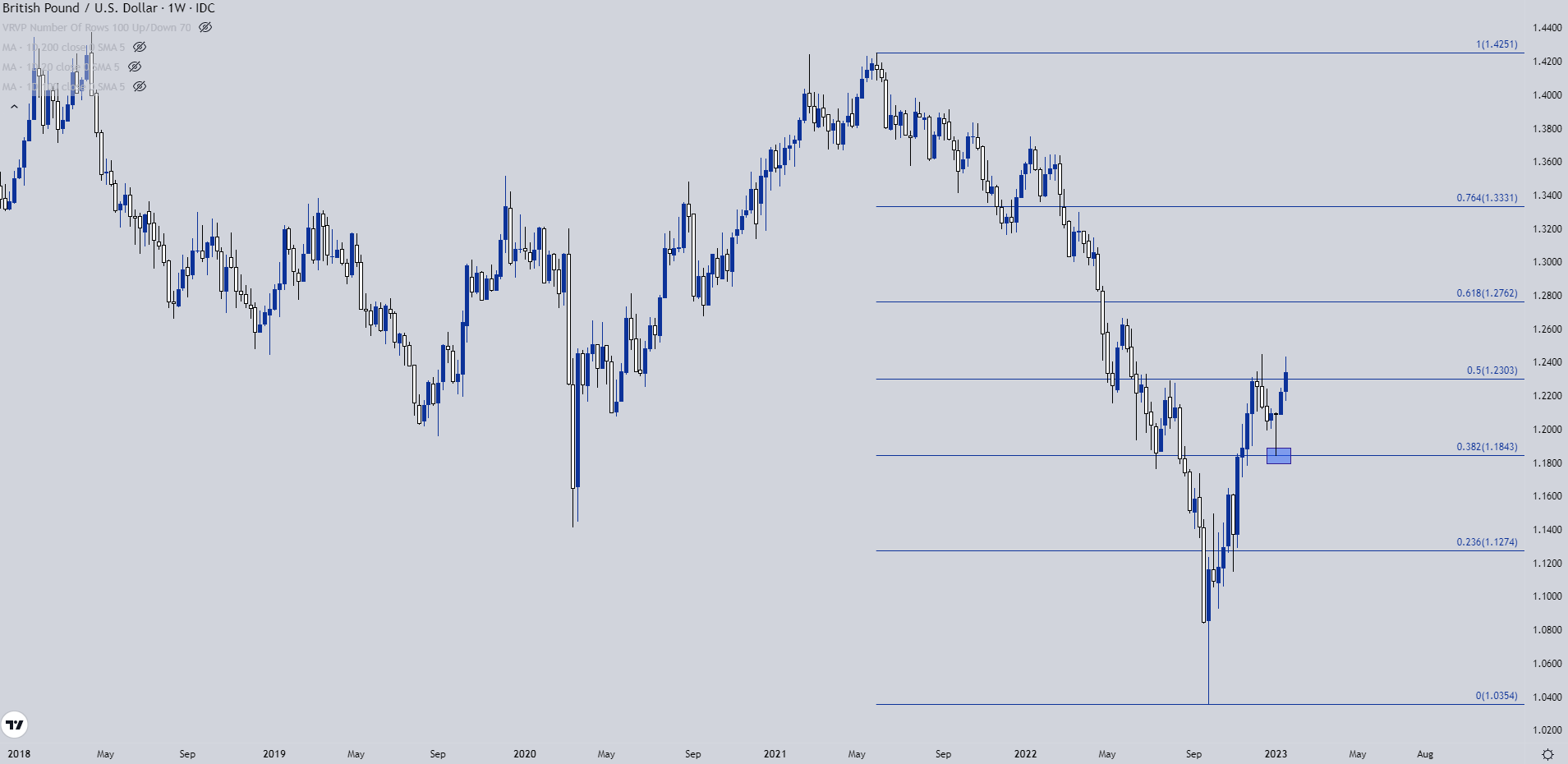

GBP/USD has had a couple of interesting inflections from the Fibonacci retracement taken from the 2021-2022 major move. In December, the 50% mark from that study helped to hold the highs over a three-week-period. There were intra-week breaks but no weekly candle closes above that level, thereby retaining it as a spot of possible resistance. And more recently, the 38.2% retracement from that Fibonacci study caught the low at 1.1843 in the first week of the year.

The big question now is whether bulls can hold the move to allow for a close above 1.2303 going into the end of this week. A weekly close below that level, particularly if this week’s high remains inside of the December swing high, keeps the door open for short-side swings, looking for a move back towards the 1.2000 handle.

Recommended by James Stanley

Get Your Free GBP Forecast

GBP/USD Weekly Price Chart

Chart prepared by James Stanley; GBPUSD on Tradingview

USD/JPY

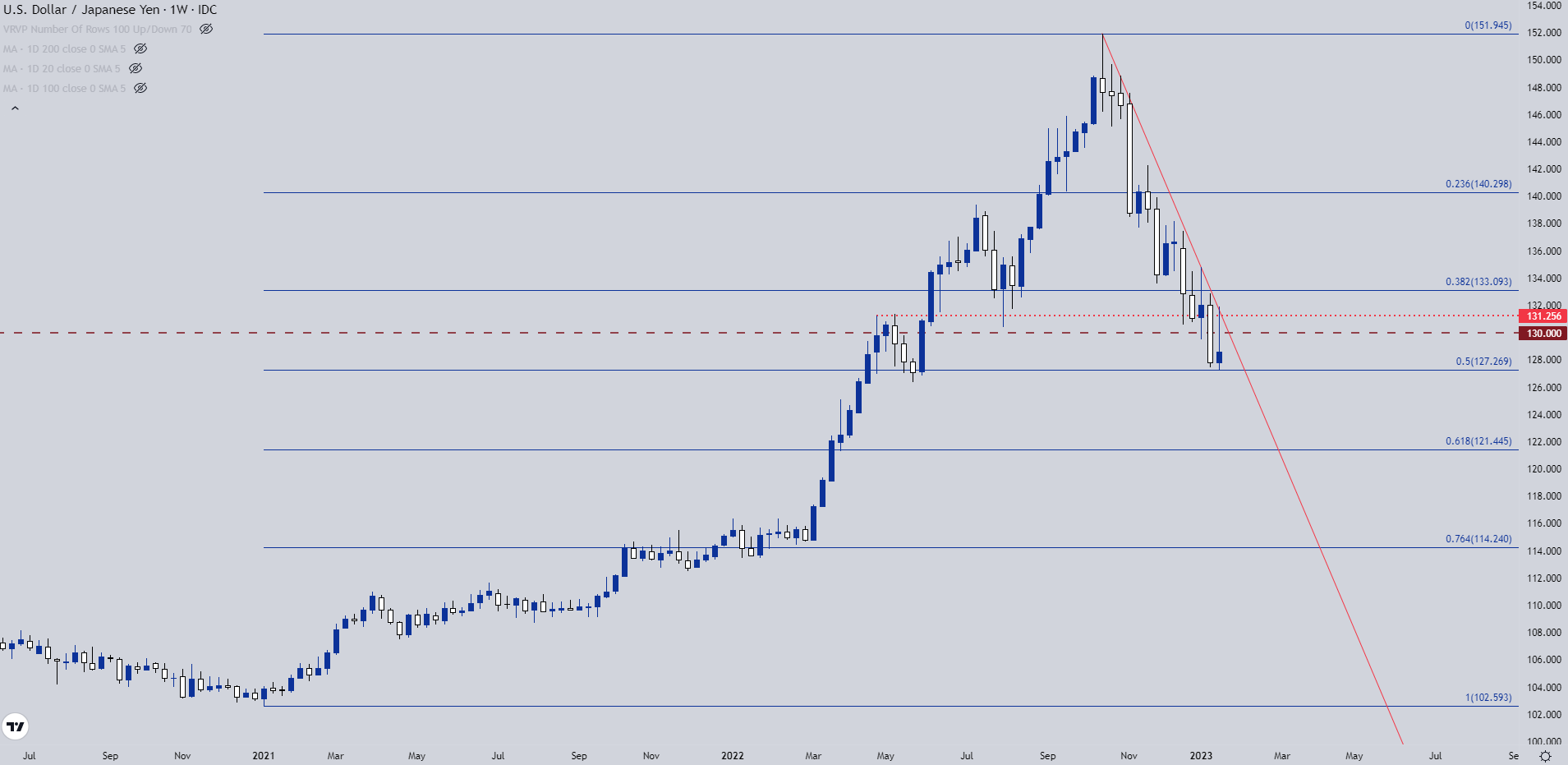

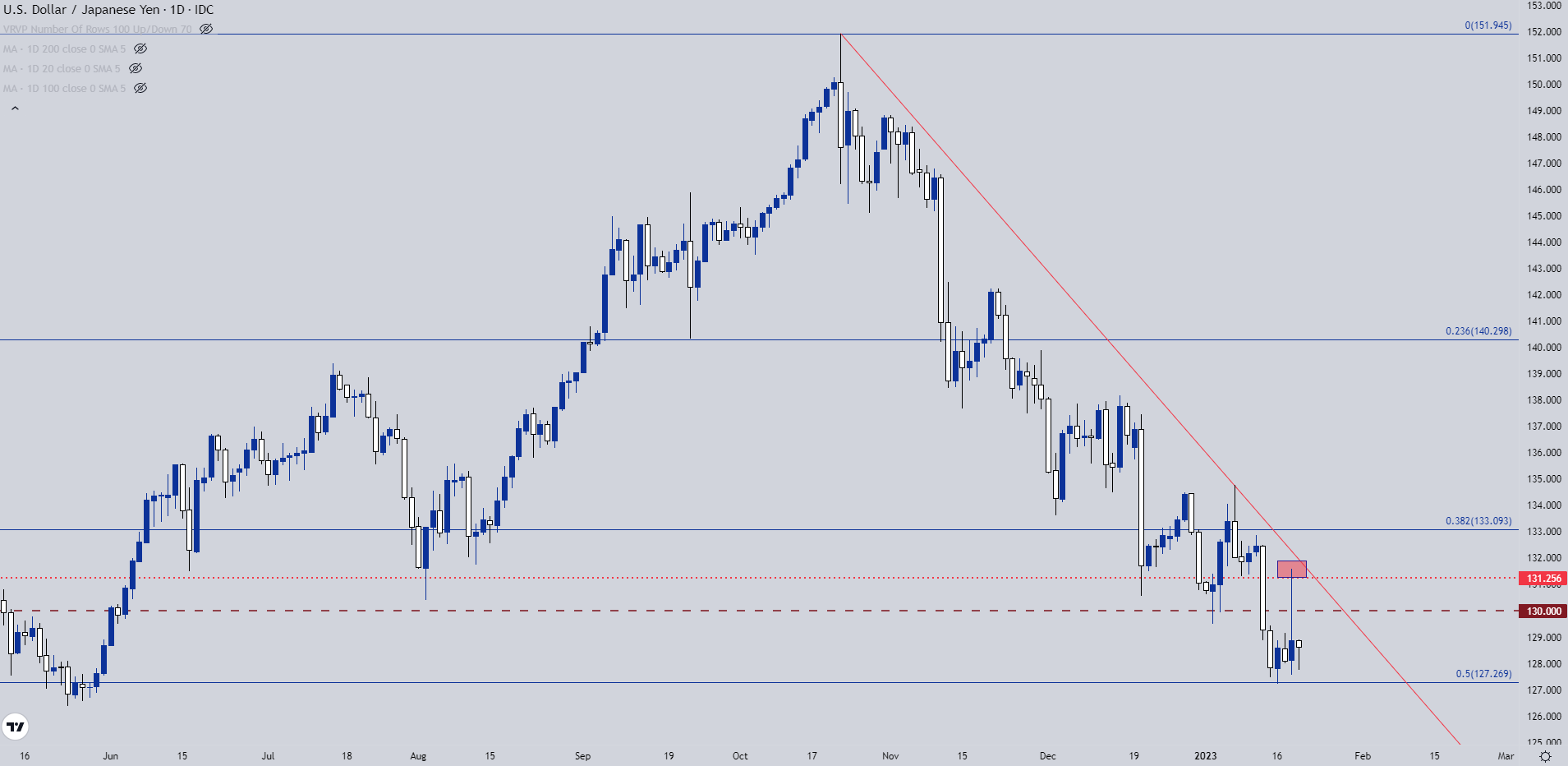

It’s pretty clear from longer-term charts that the trend has flipped in USD/JPY. The bullish trend took 21 months to build but in the three months since price has topped, 50% of that move has already been clawed back. This is a pretty classic case of ‘up the stairs, down the elevator’ and there’s even some fundamental backing of a similar nature.

On the way up, the carry trade drove the trend as higher US rates and cheap Yen allowed for a smooth ride higher. But, as US rates began to move lower and as signs began to stack that, perhaps the BoJ would be nearing some element of change on the horizon, the trend reversed and has been bearish since the middle of October.

And as clearly illustrated from the weekly chart below, sellers haven’t exactly been bashful about pushing this market lower.

USD/JPY Weekly Price Chart

Chart prepared by James Stanley; USDJPY on Tradingview

USD/JPY Shorter-Term

Sellers are still active as highlighted yesterday. USD/JPY popped after the BoJ meeting when the Bank of Japan didn’t make any changes to policy. The long upper wick on yesterday’s candle after testing above 131.25 shows this well. But – the key takeaway at this point is that sellers were rebuffed at the lows and were unable to re-test the Fibonacci level at 127.27.

So, this remains a market where rips can be attractive for bears and there’s resistance potential at the 130 psychological level, which was a prior spot of support on the way down. Above that, 131.25 could remain as an interest resistance level, as could 133.09 which is the 38.2% retracement of the same study from which the 50% mark has helped to set the low.

Recommended by James Stanley

Get Your Free Top Trading Opportunities Forecast

USD/JPY Daily Price Chart

Chart prepared by James Stanley; USDJPY on Tradingview

— Written by James Stanley

Contact and follow James on Twitter: @JStanleyFX