FTSE 100, Dax 40 Talking Points:

- FTSE 100 – price action unchanged around 7770.

- Dax 40 resilience holds above 15,100.

- Stocks remain firm despite rising fundamental risks

Recommended by Tammy Da Costa

Get Your Free Equities Forecast

Stock Indices Remain in Narrow Range Ahead of Next Week’s Event Risk

It’s been an uneventful week for European equities, with Dax, FTSE and CAC trading with limited motion. Ahead of next week’s event risk, earnings and recession fears have remained prevalent for risk assets.

With major central banks expected to raise rates next week, stocks have remained vulnerable to the fundamental backdrop.

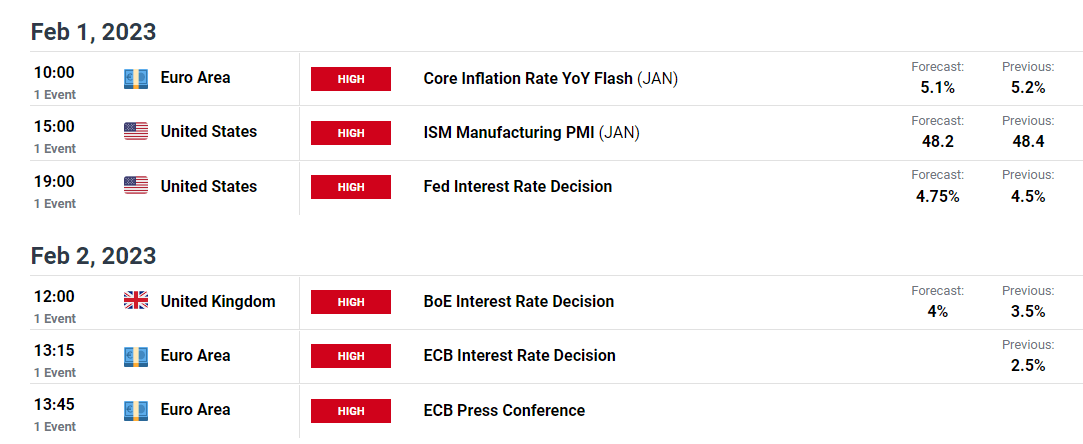

DailyFX Economic Calendar

Visit DailyFX Education to learn about the role of central banks in global markets

Balancing Growth & Price Pressures – Dax 40, FTSE 100 Remain Optimistic Above Support

Although China’s ongoing lockdowns have contributed to the lower demand for energy (which has been a prominent driver of rising inflation), the reopening of the economy is positive for broader growth prospects.

While recent economic data suggests that price pressures have eased (slightly), major equity indices have benefited from lower rate forecasts.

As the UK 100 hovers around 7790, the Germany 40 remains below Fibonacci resistance at 15,296. With the energy sector supporting the France 40 index, the recent stock rally appears to be losing momentum.

Recommended by Tammy Da Costa

Trading Forex News: The Strategy

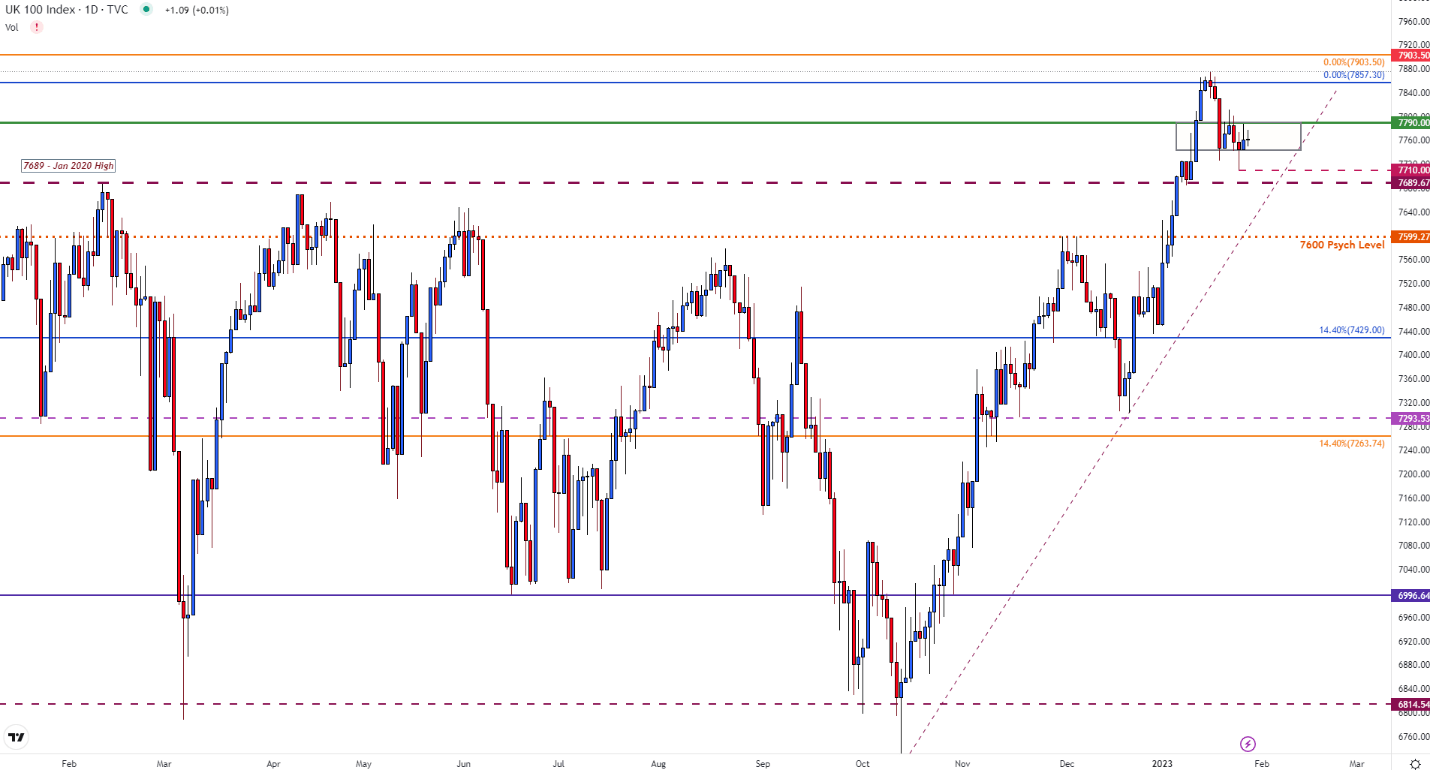

FTSE (UK 100) Technical Analysis

At the time of writing, the FTSE 100 is threatening resistance at the prior support level of 7800. With the weekly high at 7811, a pullback below 7790 has humbled bulls. With support now forming at the weekly low of 7710, the rebound has been muted by another key barrier at 7750.

While the current daily and weekly chart highlight the shallow candles that have driven FTSE into a narrow zone, prices have stalled around the 7760 mark.

UK 100 (FTSE) Daily Chart

Source: TradingView, Chart by Tammy Da Costa

With the all-time high of 7903.5 looming ahead, a hold above the January high of 7689 could support higher prices. As sentiment continues to drive prices, it is important to consider the implications of deteriorating growth forecasts.

If investors expect the UK to face a severe recession, bears could be presented with the opportunity to drive prices lower. Although prices currently remain well-above longer-term support at the 2020 high of 7689, the weekly low has formed an additional barrier of support at 7710.

Recommended by Tammy Da Costa

The Fundamentals of Range Trading

DAX 40 Technical Analysis

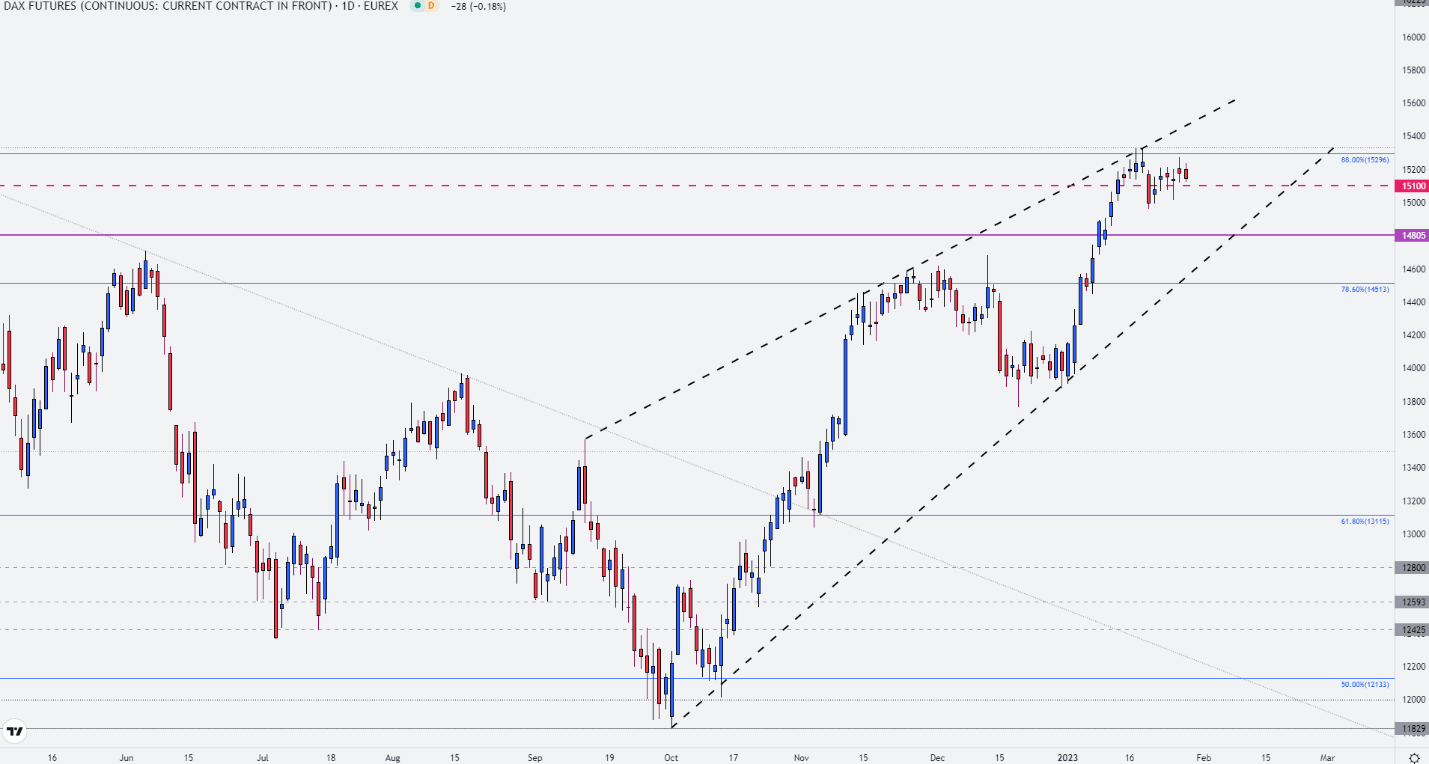

Similarly, Dax is also trading between a narrow zone of support and resistance between 15,100 & 15,200. While the psychological levels continue to form a zone of confluency for price action, the 88% Fibonacci level of the 2020 – 2022 move remains as critical resistance at 15,296.

Dax Daily Chart

Source: TradingView, Chart by Tammy Da Costa

With the rising wedge from the October low currently intact, a move below 15,100 and 15,000 could bring the lower-bound of the wedge into play at 14,805. Meanwhile, if prices rise above 15,200, a break of Fibonacci resistance could drive prices back towards 15,400.

— Written by Tammy Da Costa, Analyst for DailyFX.com

Contact and follow Tammy on Twitter: @Tams707