Investor concerns over Tesla’s performance throughout 2022 are still evident in early 2023. The stock has fallen to a low of $108.22 representing a decline of over -63% since the stock split. Increased competition from Ford, GM, Rivian and Lucid Group, lawsuits over accidents, retreating car factory performance as well as criticism of Elon Musk over the recent acquisition of Twitter have worsened the company’s recent stock performance.

In yesterday’s trading (03/01), Tesla’s share price fell another -12%, due to concerns over slowing demand. The shadow of recession continues to hit the tech sector, as inflation remains high and interest rates rise, as well as severe supply chain disruptions due to Covid in China. Tesla is still battling production and logistics challenges from 2022, including the closure of its largest production plant in Shanghai earlier in the year.

On Monday (02/01), Tesla reported record production and deliveries for its fourth-quarter electric vehicles, but missed estimates. The company delivered 405,278 vehicles in the last three months, compared to expectations of 431,117 vehicles. In the same period a year earlier, deliveries totalled 308,600 vehicles. Overall, Tesla made 439,701 cars in the fourth quarter.

One factor that may have contributed to Tesla’s stock price falling lately is investors’ doubts over Elon Musk’s ability to do his job well with some of the companies he holds. Musk is the CEO of Tesla, SpaceX, Twitter and The Boring Company and these are all big companies. And the acquisition of a struggling social media company is a thorn in the flesh that is being discussed online.

In addition, rising inflation in recent years has increased costs that siphon off company margins. The cost of working on most goods and labour has gone up. This is also a concern, that Tesla’s margins and profitability will shrink. Not to mention the significant challenges from China, the world’s fastest growing market which has been hit by rising Covid-19 cases and deaths. Recent reports suggest that the company plans to cut prices in China in a bid to boost demand in the near future.

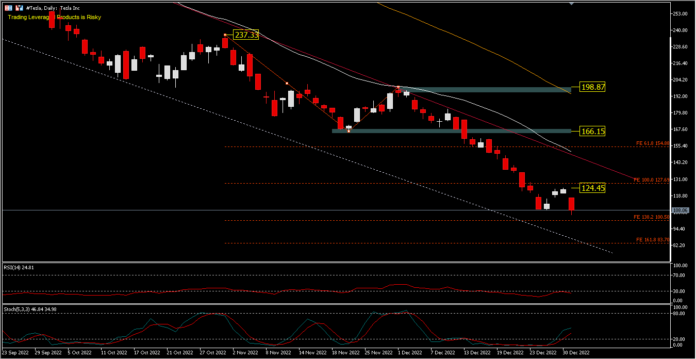

Technical Overview

The daily chart currently shows that the #Tesla stock price is in a strong bearish trend and has just broken the 2022 low of 108.22 in yesterday’s trading by registering a new low of 104.63. The stock has moved below all moving averages, while the oscillation indicator has moved below oversold levels. The major bias remains on the south side with the 100.00 round figure as a foothold. However with the FE drawdown, from 237.33-166.16 and 198.87, a decline is still projected for the FE 161.8% level at 83.70.

A move above 124.45 will cloud the outlook and prices are likely to consolidate first, whereas a move above the resistance at 198.87 would invalidate the bearish view. However, Tesla remains the leader in the EV market, so investors will likely try to find a bottom near current levels.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst – HF Educational Office – Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.