Introduction to the Stochastic Momentum Index Blau SMI Indicator

The Stochastic Momentum Index (SMI) was developed by William Blau, which is a smooth oscillator based on the Stochastic Momentum Indicator. This indicator is a version of the SMI Indicator based on the original formula made by William Blau.

What is the Stochastic Momentum Index Blau SMI Indicator?

The Stochastic Momentum Index Blau SMI Indicator is a momentum indicator which indicates momentum direction using an oscillator. This oscillator is derived from the Stochastic Momentum Indicator. It simply uses several layers of smoothening on the Stochastic Oscillator giving it a distinctly smooth oscillating line.

This indicator plots a line which theoretically oscillates within the range of -100 to 100. However, it plots an even tighter range which is normally within the range of -40 and 40.

The range of this indicator also has markers at levels 0, -40, and 40.

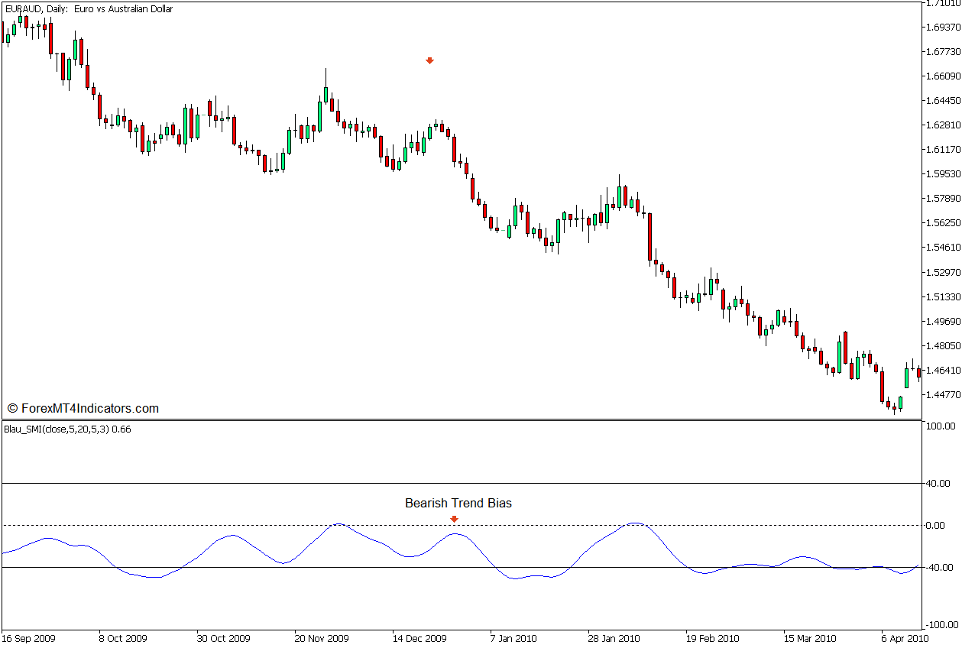

The marker at zero represents the middle line of the range. The Stochastic Momentum Index Blau line typically stays below zero in a downtrend, and above zero in an uptrend.

The markers at -40 and 40 represent the oversold and overbought levels. Oscillator lines dropping below -40 indicates an oversold market, while lines breaching above 40 indicates an oversold market.

How the Stochastic Momentum Index Blau SMI Indicator Works?

The Stochastic Momentum Index Blau SMI Indicator uses an underlying Stochastic Oscillator as the basis for its calculations. It then applies three layers of smoothing on the Stochastic Momentum Indicator using an Exponential Moving Average (EMA) method. It is somehow like a Triple Exponential Moving Average (TEMA) on the Stochastic Momentum Indicator. However, at each layer of the smoothing process, the indicator would use different variables which differs from the standard TEMA.

How to use the Stochastic Momentum Index Blau SMI Indicator for MT5

To properly apply this indicator on a price chart, traders should first copy the “williamblau.mqh” file on the “Include” file within the MT5 Data Folder.

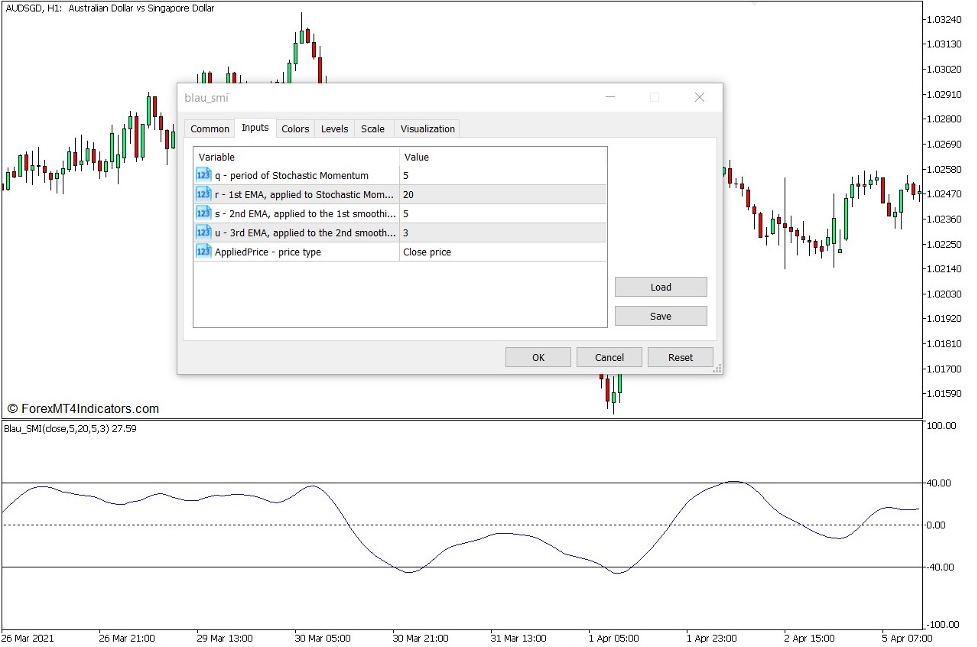

This indicator has a few variables which can be modified within its indicator settings.

“q – period of Stochastic Momentum” modifies the number of periods used on the underlying Stochastic Oscillator.

“r – 1st EMA” modifies the number of periods used on the EMA of the Stochastic Momentum.

“s – 2nd EMA” modifies the number of periods used on the second round of smoothing.

“u – 3rd EMA” modifies the number of periods used on the third round of smoothing.

Although this indicator can technically be used for identifying mean reversals based on reversals from the -40 and 40 level, its smoothing can cause some lag.

This indicator can also be used effectively as a trend direction filter based on where the oscillator line generally is in relation to its midline, which is zero.

Buy Trade Direction Bias

Identify uptrend markets based on an oscillator line which is generally above zero and trade bullish trend direction trades exclusively.

Sell Trade Direction Bias

Identify downtrend markets based on an oscillator line which is generally below zero and trade bearish trend direction trades exclusively.

Conclusion

This indicator may have too much lag to be used as a trade signal. However, it is very effective as a trend direction filter. It is best to use other trade signals in confluence with the trend direction indicated by this oscillator for an accurate yet timely trade entry.

MT5 Indicators – Download Instructions

Stochastic Momentum Index Blau SMI Indicator for MT5 is a Metatrader 5 (MT5) indicator and the essence of this technical indicator is to transform the accumulated history data.

Stochastic Momentum Index Blau SMI Indicator for MT5 provides for an opportunity to detect various peculiarities and patterns in price dynamics which are invisible to the naked eye.

Based on this information, traders can assume further price movement and adjust their strategy accordingly. Click here for MT5 Strategies

Recommended Forex MetaTrader 5 Trading Platforms

#1 – XM Market

- Free $50 To Start Trading Instantly! (Withdrawable Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Claim Your $50 Bonus Here <<

Click Here for Step-By-Step XM Broker Account Opening Guide

#2 – Pocket Option

- Free +50% Bonus To Start Trading Instantly

- 9.6 Overall Rating!

- Automatically Credited To Your Account

- No Hidden Terms

- Accept USA Residents

How to install Stochastic Momentum Index Blau SMI Indicator for MT5.mq5 to your MetaTrader 5 Chart?

- Download Stochastic Momentum Index Blau SMI Indicator for MT5.mq5

- Copy Stochastic Momentum Index Blau SMI Indicator for MT5.mq5 to your Metatrader 5 Directory / experts / indicators /

- Start or restart your Metatrader 5 Client

- Select Chart and Timeframe where you want to test your mt5 indicator

- Search “Custom Indicators” in your Navigator mostly left in your Metatrader 5 Client

- Right click on Stochastic Momentum Index Blau SMI Indicator for MT5.mq5

- Attach to a chart

- Modify settings or press ok

- Indicator Stochastic Momentum Index Blau SMI Indicator for MT5.mq4 is available on your Chart

How to remove Stochastic Momentum Index Blau SMI Indicator for MT5.mq5 from your Metatrader 5 Chart?

- Select the Chart where is the Indicator running in your Metatrader 5 Client

- Right click into the Chart

- “Indicators list”

- Select the Indicator and delete

Stochastic Momentum Index Blau SMI Indicator for MT5 (Free Download)

Click here below to download: