Fortinet, Inc., a technology company providing network security equipment and network security solutions for service providers and government entities worldwide, with a market capitalization of $42,453,103,809, is expected to report earnings on February 07, 2023, after the close of the market. The report is for the fiscal quarter ending December 2022. The market expects companies to deliver higher earnings increases and this widely known consensus outlook is important in assessing the company’s earnings picture. A factor that may influence the stock’s short-term price is how the actual results compare to those forecasts. Over the past few years Fortinet’s quarterly revenue has steadily increased, driven by growing demand for cybersecurity.

Better earnings reports can help the stock move higher, especially if this key number is better than expected. On the other hand, if it misses, the stock can move lower. The network security company is expected to post quarterly earnings of $0.39 per share in its forthcoming report, which shows a year-over-year change of +56%. Revenue is expected to be $1.29 billion, up 34.2% from the year-ago quarter.*

Fortinet reported Investor Fortinet Q3 in September 2022 with EPS of $0.35 and revenue at $1.1 billion. According to Earnings Whispers, the consensus earnings estimate is $0.27 per share on earnings of $1.1 billion. The company said it expects non-GAAP Q4 earnings of between $0.38 and $0.40 per share for an earnings figure of $1.275 billion to $1.315 billion. The current consensus earnings estimate is $0.35 per share on earnings of $1.27 billion for the quarter ending December 31, 2022.

Analysts at J.P. Morgan, Tipranks, “With less than $200 billion of corporate spending to address the more than one trillion dollar estimated annual cost and value damage related to cybercrimes, we expect Security budget growth to outpace IT budget growth over the full year and by multiples today. Below pre-pandemic levels, we see some interesting opportunities in Security.” JP Morgan began its coverage of Fortinet overweight with a target price of the stock at $69, suggesting a one-year upside potential of 31%.

Technical Review

#Fortinet,D1 – Last week’s share price closed at $52.97 and throughout the month of January 2023 until last Friday’s close, it has accumulated gains of around +15% . The daily chart shows a Cup pattern forming with the immediate resistance seen at $54.52 and price currently sitting above the 52 day EMA with minor support at $50.85. Fortinet executed a stock price split in June 2022, and since then the price has moved further downwards finding a bottom at $42.26 in November 2022. However the share price has rebounded from its low to register a gain of more than 25%.

A break of the $54.52 resistance could extend the rise to $58.24 and $63.45 especially if supported by better reports. While the move under support is minor, $45.99 will be the closest testing level. The RSI seems to be showing a slight weakening of the rally momentum, after trading within a 2-day range last week.

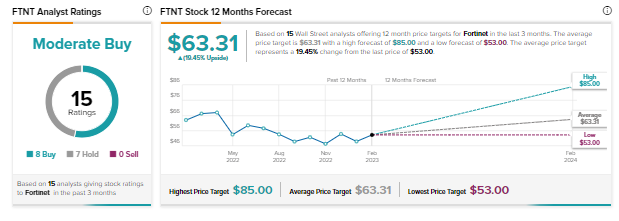

Based on 15 Wall Street analysts who offered 12 month price targets for Fortinet in the last 3 months, the average price target is $63.31 with a high forecast of $85.00 and a low forecast of $53.00. The average target price represents a 19.45% change from the last price of $53.00.

*https://www.zacks.com/stock/quote/FTNT

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst – HF Educational Office – Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.