Dear friends! In this article, we will talk about the Parabolic SAR indicator. Unlike the previously discussed Stochastic and MACD oscillators, it is designed to accurately determine trend direction and the point of reversal with an accuracy of one bar. The parabolic SAR indicator is one of the most efficient technical trading systems and it is used by most inventors to analyze the price action and the trend direction.

The article covers the following subjects:

Today I will introduce you to this efficient technical indicator, its advantages and disadvantages, signals, peculiarities of trading with it on the Forex market and many other secrets that are used with the parabolic SAR trading strategy. I will separately consider five trading strategies that work with the SAR as financial instruments in order to determine trend direction. I will also analyze examples of the real market.

What is Parabolic Sar?

Parabolic SAR stands for Parabolic Stop And Reverse. It is a trend indicator with a minimal lag that can be used in almost any timeframe in order to monitor the price movement of any asset in the financial markets. This and the good forecasting accuracy are the reason for the great popularity of the Parabolic SAR indicator when someone chooses to trade Forex. As we have already mentioned the SAR monitors the trend direction. It shows who is stronger on the market — bulls or bears, and allows you to identify the conditions for a trend change, as well as the potential entry and exit points of trending markets.

In the chart above, the technical indicator looks like dots, each of which corresponds to its own candlestick. In an uptrend where the buy signals highlight a strong trend upwards, the dots are located below the bars, and in a downtrend, above them. The formation of a correction or reversal is accompanied by a “jump” of the dot to the opposite side, which means that the current trend will reverse.

Continuing the description of the PSAR indicator, I should note that it can also be used as a stop loss and trailing stop technical indicator. When the price crosses the current dot of the indicator, the trader receives a signal of the trend correction or reversal.

The parabolic stop and reverse indicator

The SAR was created by J. Welles Wilder Jr. In addition to this indicator, he is known as the inventor of the RSI and DMI — two other classic instruments that are available in most trading platforms and are used to specify the trend direction.

Let’s return to the description of the Parabolic SAR indicator. Wilder was looking for a system that would maximize profits from trend movements. The resulting Parabolic indicator allows you to calculate both the beginning of a new trend and the asset’s initial value, as well as its end where the trade’s exit signal is located.

At the same time, PSAR does not try to guess the extreme point of the movement. It follows the trend of the price action, making it possible to maximize profits by gradually shifting the take profit level, and shows investors potential exit points to avoid the high risk of losing trades.

The indicator can be applied to any trading instruments with prevailing trend movements and can be combined with other technical indicators such as the relative strength index, average directional index, moving average, etc. At the same time, the developer does not recommend trading on a trending market using timeframes below one hour. Also, the indicator is not recommended for use in case of price fluctuations in a flat. In a sideways movement, Parabolic gives a large percentage of false signals for the price action of an asset, hiding a high risk of losing trades.

For safe use, do not trade with it in a flat. You can use the Bollinger Bands, which I talked about in previous articles, or other popular technical trading systems. Then, using the Parabolic, confirm the trend acceleration. Acceleration will occur as long as the indicator dots maintain their position below or above the chart, depending on the price movement vector. When the Parabolic SAR reverses, this is a signal for a trend reversal and a possible buy or sell signal.

In the EURUSD chart, yellow areas mark the moments of PSAR reversals where the asset’s current trend reverses. Such situations indicate a trend reversal. And the rest of the time, when the dots are consistently above or below the candles, directional movement occurs.

How Parabolic SAR is calculated

The Parabolic SAR calculation is done using an algorithm with two Parabolic SAR formulas. The first one is used for long positions (uptrend):

PSAR(i) = (HIGH(i-1) – PSAR(i-1)) * AF+PSAR(i-1)

Another parabolic SAR calculation is used when an exit signal is spotted and the trader enters a short position (downtrend):

PSAR(i) = (LOW(i-1) – PSAR(i-1)) * AF+PSAR(i-1)

Where:

- PSAR is the Parabolic value. With index (i) it’s the current value, and with (i – 1) it’s the value preceding the calculated one.

- HIGH is the price high.

- LOW is the price low.

- AF is the acceleration factor. Its value grows with a step set for each period when new extreme price values are reached. Wilder recommends using an initial factor of 0.02, which increases by 0.02 with each new bar until it reaches a maximum value of 0.2.

AF formula:

АF = 0,02 + ix*K

Where:

- ix is the number of periods accumulated since the beginning of counting;

- K is the step of price change, which by default is 0.02.

Important! Prior AF limit value can be changed in the LiteFinance web terminal and MT4. However, the author himself and his closest followers stick to the standard value of 0.2 when trading.

How to use the Parabolic SAR and read its signals

Let’s look at the operation of Parabolic SAR and its signals in detail:

Important! If the trending market price moves sideways, these SAR trading signals do not work. Avoid using PSAR in flat.

Let’s consider how the indicator works through the example of Ethereum in a trending market.

The last lower dot is marked with a blue circle in the ETHUSD chart. The dot that forms after it is located above the corresponding price bar (purple circle). After this sign is considered as a sell signal and a trend reversal occurs. Then, during the downward movement, we observe an increase in the distance between the points (red area) signaling the development of a more dominant trend.

I also recommend taking into account the following factors:

How to Trade with the Parabolic SAR

Let’s look at real Parabolic trading using the S&P 500 CFD as an example.

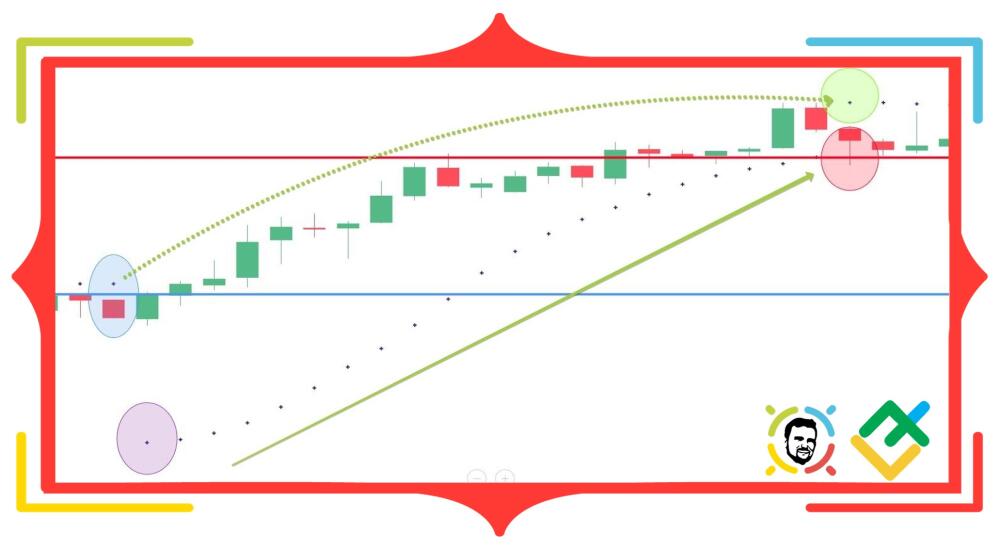

The first step is to determine the moment when a new trend begins to form in order to maximize the capturing profits from the trade. The ideal signal is a break in the curve. The blue circle marks the last upper dot of the price bar. It is followed by a gap and the first lower dot is formed showing that the price movement will start to go upwards.

We enter the market at the close of the candle (blue line). Set stop loss at the level of the Parabolic SAR indicator (red line). With each step, we will move it to the level of a new dot where the start of a different price action is spotted.

Eventually, one of the stop orders is triggered (red circle in the chart above). A reverse of the indicator has formed in the chart indicating the end of the upward movement (green circle).

In the chart above, the flat shows a good example of the PSAR not working when the price moves sideways. We can see that all 100% of the SAR trading signals are false. The dot reverses, which indicates a trend reversal. However, the price movement vector is not directed toward the indicator movement, but against it. Thus, if you are a CFD broker, for example, you need to be aware of a sideways market since SAR hides a high risk of losing a great part of your personal finance. There are other financial instruments that work as technical indicators, such as the moving average, relative strength index, and others that can help you make proper trend research and spot potential reversals, sell or buy signals, etc.

Parabolic SAR Indicator in MetaTrader 4

Now let’s figure out how to use Parabolic SAR with the MetaTrader 4 platform as an example. The indicator is already available in the terminal, so you don’t need to download and install it.

To add it to the chart, you need to find “Indicators” in the “Insert” tab or in the “Navigator” menu, select “Trend Indicators” and click on the “Parabolic SAR”.

You can also download the Parabolic Sar 24 with custom modifications and use the default settings. A popular version of this indicator is Parabolic SAR MTF (Multi Time Frame). You can download it here.

The installation procedure in MT4 is standard. See the example in the article “Forex Bollinger Bands Indicator”.

Unlike the regular version, Parabolic SAR MTF is capable of showing curves from several timeframes at once. For example, the chart above shows the weekly and daily PSAR for BTCUSD price movements. It is convenient for tracking market dynamics at different levels and for doing end-to-end analysis of several timeframes in one window. Moreover, it strengthens your trading style and boosts the capturing profits, by avoiding the high risk that may hide other complex instruments which are mostly used on live markets.

To set up the desired timeframe, you need to modify the default settings and specify the required number of minutes in the data entry tab for the TimeFrame parameter. Use this table:

| Value | Timeframe |

|---|---|

| 1 | M1 |

| 5 | M5 |

| 15 | M15 |

| 30 | M30 |

| 60 | H1 |

| 240 | H4 |

| 1440 | D1 |

| 10080 | W1 |

| 43200 | MN1 |

Another interesting type of this indicator is the Parabolic SAR Color Alert. It allows you to customize the colors of the dots for an uptrend and a downtrend separately and recognize the type of trending markets. The indicator also has sound alerts for every trend change informing about potential reversals.

The download link for the Parabolic SAR Color Alert indicator is here.

Other indicators that have the role of advisors and are based on Parabolic are useful too. One of these tools is the MQLTA Parabolic SAR Trailing Stop. Its function is to pull up the stop loss level to the indicator dots. This way the user does not need to move the level manually.

You can download the script from this page.

Pros and Cons of the PSAR

After using the Parabolic for a while I have highlighted the following advantages of this tool:

-

The indicator allows you to keep a position within the trend. As long as the continuous price action curve continues to form, you can be confident that directional movement is developing. In addition, the current strength of the trend can be indirectly measured by the distance between the dots. When it shrinks, you should be preparing for potential reversals.

-

Parabolic SAR takes into account not only the dynamics of the trend development of the price action but also its duration.

-

Few false signals and small delays during directional movement on the market.

-

The indicator shows when a sell signal occurs and where to place your stop loss.

-

Following the signals, PSAR is insured against trading against the trend.

And now to the disadvantages:

The SAR Indicator Settings

The best settings are the standard Parabolic parameters.

The initial factor is 0.02, the price step is also 0.02, and the maximum AF is 0.2. Most traders use these settings for the Parabolic. Wilder also used them. These parameters allow you to trade on most common timeframes above H1 and get high-quality buy and sell signals.

Moreover, the lower the acceleration factor, the less it will follow the price. On the other hand, the higher the acceleration factor, the closer to the price it will move. Therefore, increasing the factor increases the sensitivity of PSAR, while lowering it decreases it. We will use this feature to determine the optimal settings for different timeframes.

Best Parabolic SAR settings for intraday

The standard Parabolic SAR settings are quite applicable for classic intraday trading. In rare cases, when it comes to the timeframes M5 and M15 and the indicator needs higher sensitivity, the acceleration factor starts with a 0.021 step.

Parabolic SAR settings for 5 minute chart

For the M5 timeframe, I would stick to Wilder’s classic teachings and also use the Parabolic SAR setting with a step of 0.021 as the lowest price for the step. It is quite sensitive to fluctuations in five-minute charts. But the strategy using two Parabolics in a five-minute chart suggests adjusting one of the indicators in 0.04 increments.

Best Parabolic SAR settings for scalping

Scalping in the classic version, especially when it comes to trading on minute timeframes, requires the settings that are most sensitive to price changes. So it is best to set the largest value recommended by Wilder at 0.022.

There are also trading strategies with Parabolic settings beyond the values recommended by the creator with a step of 0.05 and even more, which can be used with your own risk on trading cfds, currency pairs, etc.

Parabolic SAR strategy

The high accuracy and easy use of PSAR have become the reason that this indicator is used in many successful trading systems. Strategies using Parabolic can include several versions of this tool as financial instruments. In this case, the authors of trading systems strive to reduce the disadvantages of using one indicator by using different timeframes and settings.

The second option is the combined Parabolic SAR strategies. In addition to Parabolic, they include other indicators and signals for potential reversals, for example MACD or moving average crossovers.

Below I will tell you about five working Parabolic strategies that are popular among many traders that can be used with PSAR and boost your personal finance.

Double parabolic SAR strategy

This trading system is designed to trade currency pairs, indices, metals, and commodities in a five-minute chart (intraday).

Parabolic SAR indicator setup and trading strategy:

- Parabola 1 – initial factor 0.02, step 0.02, limit 0.2;

- Parabola 2 – initial factor 0.02, step 0.04, limit 0.2.

Conditions for entering a buy position:

- Two points jump from the upper to the lower position.

- The stop loss is set just below the low of the opening bar.

Conditions for entering a sell position:

- Two points jump from the lower to the upper position.

- The stop loss is set just above the high of the opening bar.

Exit the position in one of the following three ways:

- when the fast Parabolic breaks;

- when a local support or resistance level is reached;

- by take profit equal to 2-3 stop losses.

Let’s consider this Parabolic indicator strategy in the bitcoin chart.

In the BTCUSD chart, a blue circle marks two dots of the fast and slow Parabolic when they moved from a position above the price to a position below the price. After receiving a signal, open a long position at the blue line level. Set a stop loss below the low of the opening candle. I’ve marked it with a red line.

Then wait for the signal to exit the market. The fast parabola breaks in the area marked with the green circle. At this moment, close the position with a small profit (green line).

EMA crossover and Parabolic SAR strategy

EMA crossover and Parabolic SAR strategy is a combination of rather complex instruments. This Parabolic SAR trade strategy allows you to trade on longer timeframes from H1 to H4. It’s suitable for any asset, even when trading cfds, but it demonstrates the best performance on classic Forex currency pairs, indices, and gold.

Indicator settings:

- Parabolic – 0.02, 0.02, 0.2;

- EMA 10 – 10 bars;

- EMA 25 – 25 bars;

- EMA 50 – 50 bars.

Conditions for entering a buy position:

- EMA 10 crosses EMA 25 and EMA 50 from the bottom up.

- PSAR reverses from top to bottom. Moreover, if this is the first lower dot, some traders open an order at the next one after it and thus receive additional signal confirmation.

Conditions for entering a sell position:

- EMA 10 crosses EMA 25 and EMA 50 from the top down.

- PSAR reverses from bottom to top. If this is the first upper dot, wait for the next one as confirmation.

Set stop loss at the point opposite the opening bar. Afterwards you can leave it there or move it along with the parabola.

You can close the position in two ways:

- After the formation of a break in the SAR curve.

- When the EMA 10 crosses the two lines, the EMA 25 and the EMA 50. This method itself results in a loss of profit due to a delay in the response of the moving averages. Therefore, it is better to use it together with a trailing stop.

Let’s try trading with this strategy using the EURJPY currency pair as an example.

The blue oval marks the moment when the fast blue EMA 10 crosses the slow green EMA 25. Before that, the fast moving average crossed the EMA 25. I marked the first lower dot after a series of dots located above the price bars with a yellow circle. After getting a signal, open a long position at the blue line. After that, set a stop loss near the parabola dot (red line).

As a trend develops, a gap forms in the indicator curve. The first dot above the price bars is marked with a green circle. Here we take profit at the green line.

Note that the EMA was not crossed because the short-term bearish move was a correction. After it, the main trend continued. This means that the second signal option to close a position allows you to reduce the influence of minor price fluctuations. However, it should be used in conjunction with a trailing stop in order to protect your personal finance.

Parabolic SAR and MACD strategy

This Parabolic strategy uses the MACD indicator, which I’ve described earlier in my article. It is easy to learn, includes only standard technical analysis tools and shows good results in any markets. The minimum time period is M15, and the optimal one is M30 and above.

Indicator settings:

- Parabolic – 0.02, 0.02, 0.2;

- MACD – 12, 26, 9.

Conditions for entering a buy position:

- The Parabolic curve forms below the price after the break, confirming the development of a bullish trend.

- The MACD histogram crosses the zero line from the bottom up during the first three lower dots of the Parabolic SAR.

Conditions for entering a sell position:

- The curve forms above the price after the break.

- The MACD histogram crosses the zero line from the top down during the first three dots of the SAR.

You can set stop losses and take profits in two ways:

- By the nearest local extremum. In this case, close by take profit of 1.5–2 stop orders.

- By the PSAR dots. Close using the Parabolic signal if the stop loss remains stationary or by trailing stop, which moves in the direction of the trend along with the PSAR points.

Let’s look at how this strategy works through the example of gold.

The blue circle in the MACD chart marks the moment when the histogram crosses the zero line. The blue circle in the price chart marks the first PSAR low after the gap. Note that in some cases the histogram crosses the zero line before the reversal signal from the Parabolic. Such situations are also considered a signal to enter the market.

After receiving all the necessary confirmation of the development of an uptrend, open a position at the blue line level. Set a fixed stop loss at the level of the parabola dot. Next, wait for a signal to close the order. A gap appears in the area marked with a green circle. On this bar, fix the profit at the level of the green line.

Parabolic SAR scalping strategy

The Parabolic SAR scalping strategy shows high efficiency on classic currency pairs like the EURUSD, GBPUSD, AUDUSD. The optimal timeframes will be M5 and M15.

We will use three instruments at once:

- Parabolic with standard settings (0.02, 0.02, 0.2);

- Commodity Channel Index (CCI) with a period of 45 bars;

- EMA with a length of 50 for M1 charts and a period of 21 for M5.

Rules for opening a long position:

- The Parabolic dot is located above the moving average;

- CCI is above the “+100” level.

Rules for opening a short position:

- The SAR dot is below the moving average;

- CCI is below the “-100” level.

Set stop loss at the nearest extreme point within 3-5 bars. You can close by take profit of 1-2 stop orders. Also, to select the optimal time for closing a position, you can use the signal of the CCI curve crossing the level +100 or –100.

The blue oval in the CCI chart marks the moment when the indicator curve reaches the oversold zone and the subsequent rebound in the opposite direction. In the EURUSD one-minute price chart, at this moment, the Parabolic dot is below the moving average.

After getting a signal to sell, open a position at the end of the candlestick located opposite the Parabolic dot marked with a blue circle (blue line). Set stop loss at the level of the nearest high (red line).

After some time, we see the CCI crossing the mark -100 (green circle). On the candlestick where this event took place, we take the profit at the level of the green line after the lowest price has been shaped.

ADX + Parabolic SAR strategy

The combination of PSAR and ADX indicators is very popular in trading strategies. Here we will look at one of the most simple but effective trading systems.

You will need:

- Parabolic SAR with standard settings – 0.02 and 0.2.

- ADX with a period of 14.

This trading strategy is popular with Forex traders. However, in my personal experience, the PSAR and ADX bundle work well together both in the cryptocurrency market and in stocks as well.

The ADX indicator itself deserves a separate mention. If you have never worked with this tool, read the article “ADX Indicator: Average Directional Index”.

In short, the ADX, like the Parabolic, is also a trend indicator. Its ability to reflect the strength of directional movement allows it to filter out sideways movements in the market, which are detrimental when dealing with PSAR signals.

Let’s look at the entry points when using this strategy:

For a long position:

- PSAR dots start their count below the price chart;

- +Di crosses -Di and is on top;

- ADX curve is greater than 13 with an upward slope.

For a short position:

- PSAR dots start their count above the price chart;

- +Di crosses -Di from the top down;

- ADX curve is greater than 13 with an upward slope.

To exit the position, one of the following conditions must be met:

- Reverse crossing of the lines +Di and -Di;

- The transition of the Parabolic dot in the direction opposite to the price chart;

- Closing by the set stop loss or take profit.

The strategy itself does not have separate conditions for determining stop loss and take profit levels at a lowest price. Reverse signals are used as the SL and TP – the PSAR reversal and reverse crossing of the ADX indicator signal lines.

If trailing Take Profit and Stop Loss are not allowed by your risk management system, the recommended indent for take profit is 2.5x the stop loss size. In this case, the stop loss level itself is set with an indent of several points from the local extremum.

Also, remember to follow the basic rules of risk management and move your stop loss to breakeven and protect profitable positions from drawdowns.

The chart above shows an example of this strategy. All three conditions for opening a long position are met. After the signal candle closes, we enter the market at the blue line.

Then we get the first reverse signal from the PSAR – the indicator dot appeared above the price chart (green circle). When the candle opens, we take the profit. I also marked the reverse crossing of the ADX signal lines with a red circle. You can see that the last signal was a little late. In practice, opposite scenarios can also occur, when the first signal is the crossing of +Di and -Di. Therefore, it is important to notice which signal appeared first.

Let’s discuss the most frequently asked questions

Conclusion

Beginners are often reluctant to use built-in indicators believing that effective tools cannot be available to everyone. The Parabolic SAR is a striking example of the opposite. The indicator’s ability to predict trend reversals and update support levels can be a good addition to any trending strategy or as a risk management tool.

The only Achilles’ heel of this indicator is the sideways movement of the market. The PSAR is not capable of filtering this alone, so it is imperative to use additional technical analysis tools indicating the absence of a trend.

If you doubt the effectiveness of Parabolic, try it out on the LiteFinance demo account. To start trading, you don’t even need to register. And the time spent on learning and testing will pay off with stable profits!

Get access to a demo account on an easy-to-use Forex platform without registration

Price chart of EURUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.