USD/JPY ANALYSIS

- All eyes on BoJ with regards to YCC and potential for future interest rate hikes.

- USD/JPY hits 7-month lows with developing ‘death cross’ possibly hinting at further downside.

Recommended by Warren Venketas

Get Your Free JPY Forecast

JAPANESE YEN FUNDAMENTAL FORECAST: MIXED

The Japanese Yen ended last week on the front foot from both USD weakness driven by softening inflation in the U.S. as well as market hopefulness around a more aggressive Bank of Japan (BoJ). Next week kicks off the major focal point for USD/JPY with the BoJ’s interest rate decision (see economic calendar below) scheduled on Wednesday.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

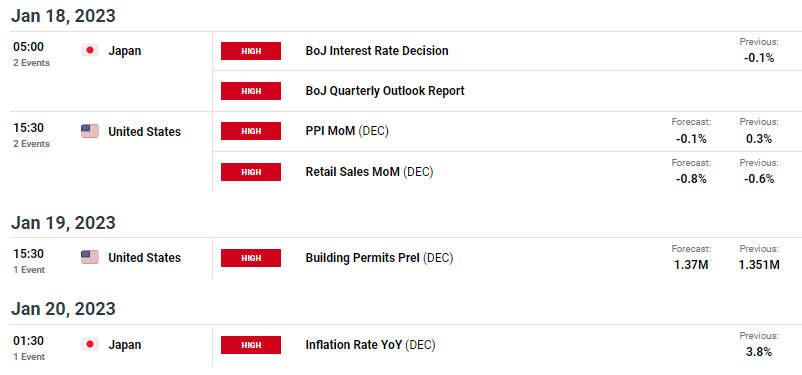

ECONOMIC CALENDAR

Source: DailyFX economic calendar

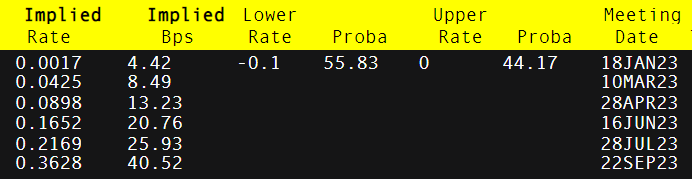

A change from the current ultra-loose monetary policy due to elevated inflationary pressures could be something that can take place next week by revising Yield Curve Control (YCC) measures or even scrapping it all together. Thus far in what has been a mostly global rate hiking cycle for most central banks, the BoJ has remained dovish in its approach but money markets are favoring a commencement of rate hikes around June/July this year. Depending on what happens in next week’s announcement, this date could be pushed forward as early as March. On the contrary, an unchanged outlook from the BoJ could really hurt the Yen particularly after the enthusiasm shown by market pricing on Friday.

BANK OF JAPAN (BOJ) INTEREST RATE PROBABILITIES

Source: Refinitiv

From a USD perspective, the greenback extends its downward trajectory but any positive economic data next week could provide some support considering markets have almost cemented the 25bps increment in the February Fed meeting.

TECHNICAL ANALYSIS

Introduction to Technical Analysis

Moving Averages

Recommended by Warren Venketas

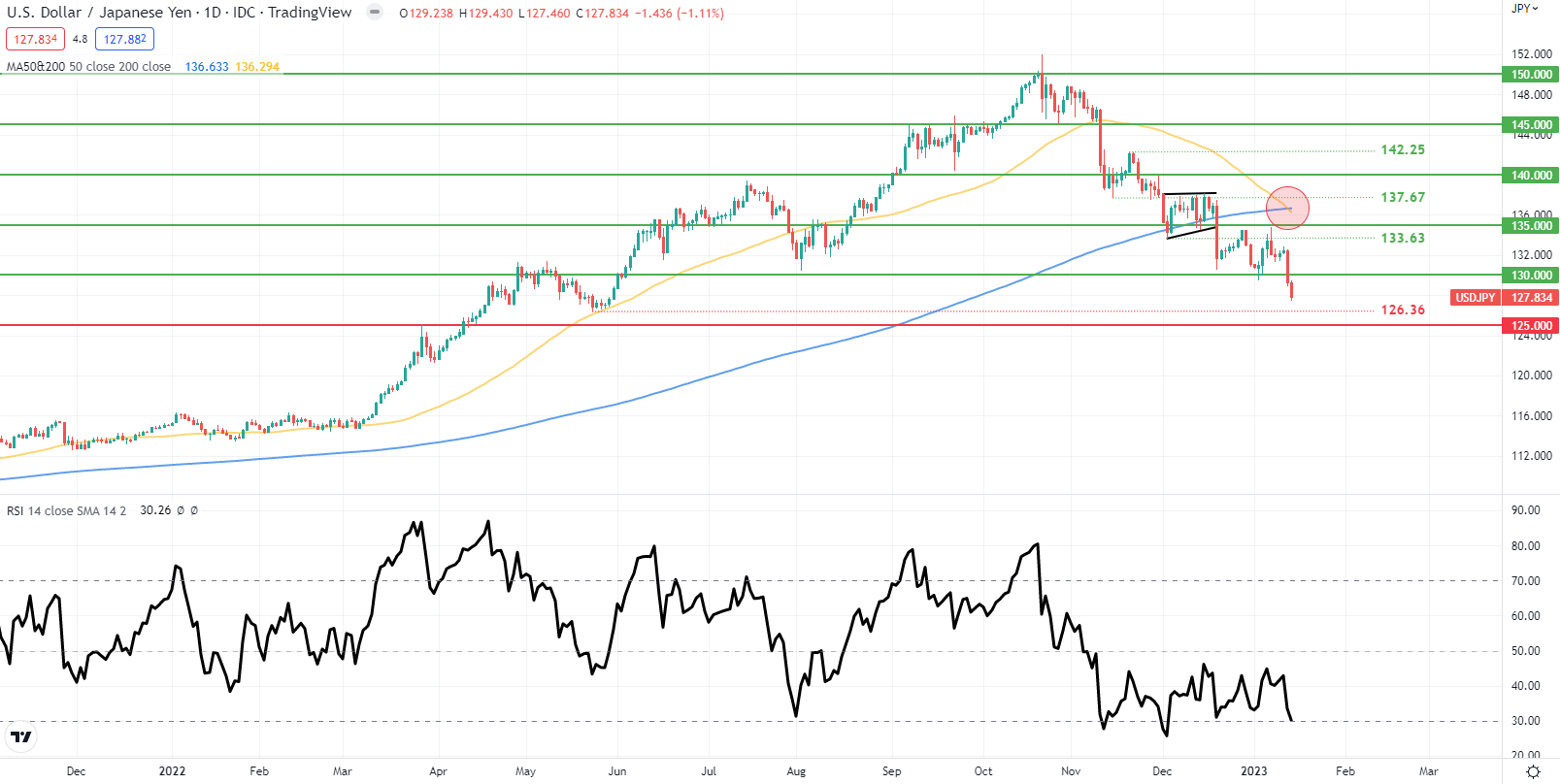

USD/JPY DAILY CHART

Chart prepared by Warren Venketas, IG

The daily USD/JPY chart shows price action falling below the 130.00 psychological handle now turned resistance. Fresh yearly lows last seen in May 2022 and could test the swing support low at 126.36. If the BoJ meeting concludes with minimal change, the pair will likely rally; however, with fundamentals favoring the JPY going forward, there could be opportunity around pullbacks to the upside.

Technical moving averages are exhibiting extremely bearish signals via the ‘death cross’ where the 50-day SMA (yellow) crosses below the 200-day SMA (blue). This initial move may have already played out due to the Moving Average (MA) indicator being lagged and looking at the bullish/positive divergence present on the Relative Strength Index (RSI), a short-term rebound higher could be in store before a subsequent leg lower.

Key resistance levels:

Key support levels:

IG CLIENT SENTIMENT POINTS TO IMPENDING DOWNSIDE

IGCS shows retail traders are currently net LONG on USD/JPY, with 58% of traders currently holding long positions (as of this writing). At DailyFX we take a contrarian view on sentiment, resulting in a short-term bearish bias.

Contact and followWarrenon Twitter:@WVenketas