Here is what you need to know on Friday, January 13:

The equity market finally rallied on Thursday after the CPI caused notable confusion. The number was bang in line with expectations and caused a complete lack of direction immediately after. Inflation is coming down, yes, but the market had priced quite a bit of that theory. In-line numbers did not really help bulls or bears in that case.

Eventually, yields remained low, allowing risk assets to move higher. The moves were limited and the rate-sensitive NASDAQ actually underperformed the more defensive Dow though, so it was not a great look going into earnings season. That earnings season really gets going next week and is likely to cap more risk-taking.

The US Dollar took another hit overnight from the Japanese Yen with JGB yields going above the new band at 0.5%. Gold is flat at $1,895, while the Dollar Index is now recovering to 102.50. Oil is holding gains at $78.63.

European markets: FTSE flat, Eurostoxx -0.1% and Dax -0.1%.

US futures: NASDAQ -1%, Dow -0.7% and S&P -0.9%.

Wall Street top news

Bank of America data sees outflows from US equities and inflows to EU/Japan equities.

Also BOA data sees large inflows to investment-grade bonds.

JPMorgan (JPM) beats on earnings.

BlackRock (BLK) beats on earnings.

Delta (DAL) beats o nearning but weak guidance.

Wells Fargo (WFC) misses on top and bottom lines.

Bank of America (BAC) beats on earnings.

Citigroup (C) more or less in line, revenue slightly ahead.

Reuters headlines

UnitedHealth Group Inc (UNH): The company reported a quarterly profit that beat Wall Street estimates

Wells Fargo & Co (WFC): The bank reported a 50% decline in profit for the fourth quarter as it paid regulatory penalties and stockpiled money to prepare for soured loans against the backdrop of a weaker economy.

Bank of America Corp (BAC): The bank reported a better-than-expected fourth-quarter profit as rate hikes helped it charge more interest on loans to customers.

JPMorgan Chase & Co (JPM): The bank reported a 6% rise in fourth-quarter profit, as a better-than-expected performance from the bank’s traders more than offset a hit from a slump in dealmaking.

Boeing Co (BA): A Boeing 737 MAX made its first passenger flight in China in nearly four years on Friday.

LendingClub Corp (LC): The company said it has laid off 14% of its workforce.

Southwest Airlines Co (LUV): The company is looking at all options to ensure the operational meltdown it suffered last month is not repeated, Chief Executive Bob Jordan said on Thursday.

Tesla Inc (TSLA): The company has slashed prices on its electric vehicles in the United States and Europe by as much as 20%, extending a strategy of aggressive discounting after missing Wall Street estimates for 2022 deliveries.

Upgrades and downgrades

Upgrades

Friday, January 13, 2023

|

COMPANY |

TICKER |

BROKERAGE FIRM |

RATINGS CHANGE |

PRICE TARGET |

|---|---|---|---|---|

|

Carrier Global |

CARR |

Mizuho |

Neutral>>Buy |

$38>>$53 |

|

Caterpillar |

CAT |

BofA Securities |

Neutral>>Buy |

$217>>$295 |

|

Community Healthcare Trust |

CHCT |

Janney |

Neutral>>Buy |

$44 |

|

Copa Holdings |

CPA |

JP Morgan |

Neutral>>Overweight |

$105>>$132 |

|

Farmland Partners |

FPI |

Janney |

Neutral>>Buy |

Downgrades

Friday, January 13, 2023

|

COMPANY |

TICKER |

BROKERAGE FIRM |

RATINGS CHANGE |

PRICE TARGET |

|---|---|---|---|---|

|

AutoNation |

AN |

Wells Fargo |

Overweight>>Equal Weight |

$126 |

|

Costamare |

CMRE |

Stifel |

Buy>>Hold |

$12.5>>$11 |

|

Corebridge Financial |

CRBG |

Credit Suisse |

Outperform>>Neutral |

$26>>$23 |

|

Casella Waste |

CWST |

BofA Securities |

Neutral>>Underperform |

$87>>$81 |

|

Dream Finders Homes |

DFH |

RBC Capital Mkts |

Sector Perform>>Underperform |

$8 |

|

Masonite International |

DOOR |

RBC Capital Mkts |

Outperform>>Sector Perform |

$91>>$89 |

|

Fortinet |

FTNT |

BTIG Research |

Buy>>Neutral |

|

|

Gladstone Commercial |

GOOD |

Janney |

Buy>>Neutral |

$17.5 |

|

Jacobs Engineering |

J |

BofA Securities |

Buy>>Neutral |

$137 |

|

KB Home |

KBH |

RBC Capital Mkts |

Outperform>>Sector Perform |

$34 |

|

Lithia Motors |

LAD |

Wells Fargo |

Overweight>>Equal Weight |

$212>>$233 |

Source: WSJ.com

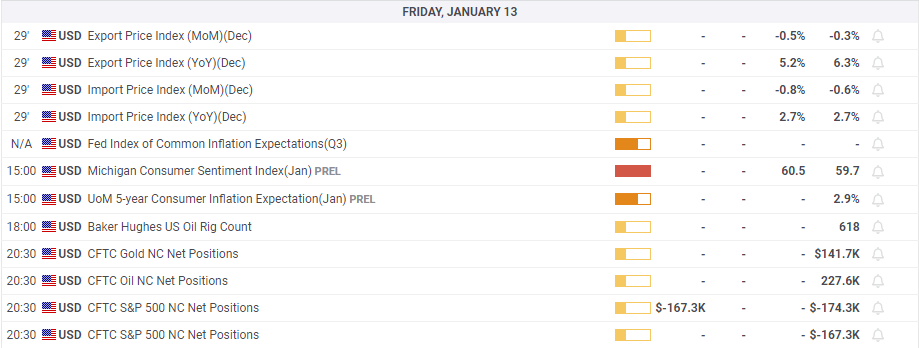

Economic releases