One of the main themes in the Benzinga Option School this week was how prominent the 380 strike was in terms of option flows. Our internal analytics showed how 380 is the largest strike by call + put gamma with 370 being the largest strike by put gamma only.

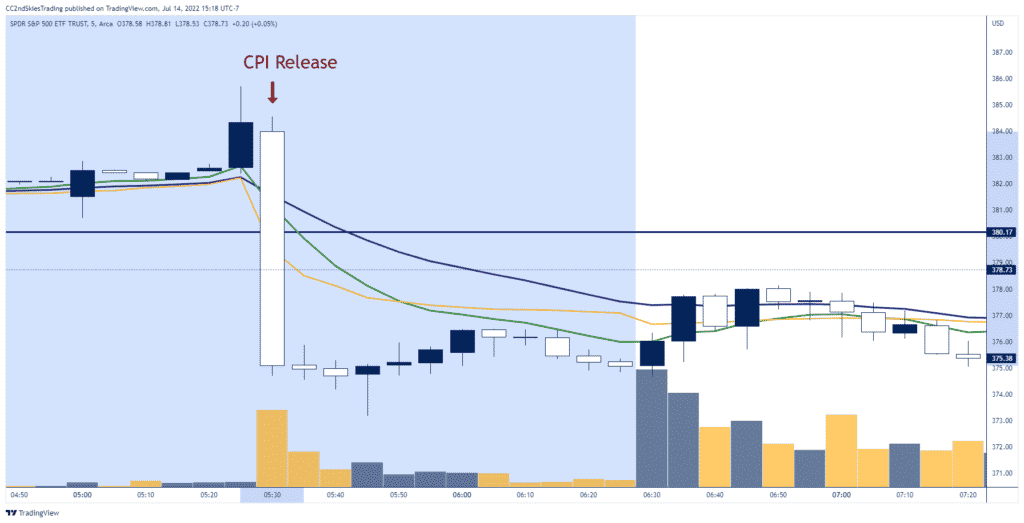

The large concentration of positions at the 380 strike suggested it would likely become resistance on pullbacks this week. Yesterday we got the CPI print with all 3 numbers coming in above estimate – showcasing how inflation is stronger than anticipated.

The market immediately sold off about 8 points in 5 minutes (see chart below), suggesting traders were worried about a) how the inflation may further hurt the economy, but more importantly b) that the FED may respond by hiking rates faster or more than anticipated.

By the time the market opened (price action after the blue box) the market was still on the lows, but started to rally about 1 hour after open.

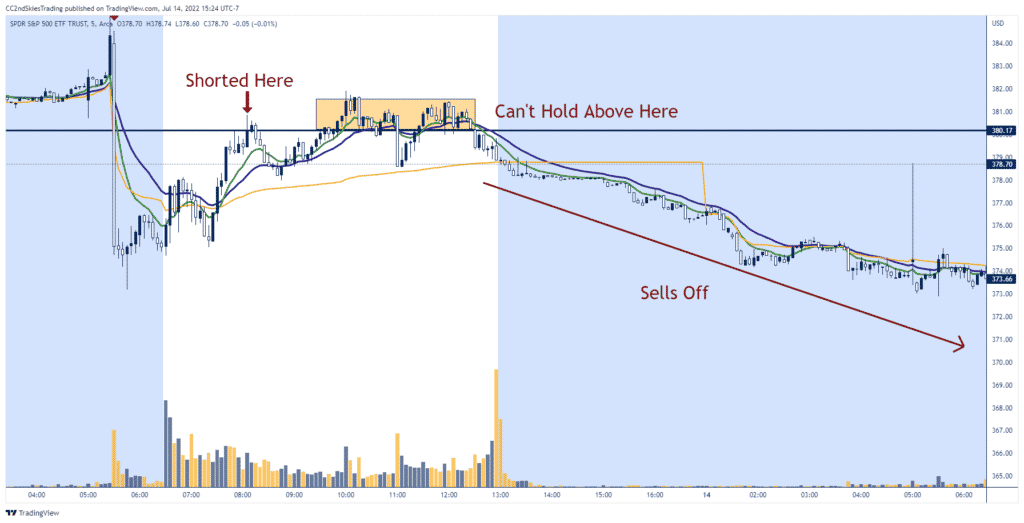

When the market rallied up to our 380 strike, which we viewed as key resistance intraday, we decided to get bearish with a put ratio spread. We executed this trade live in the Benzinga Option School.

NOTE: You can get a 7 day trial of the benzinga option school for $7, along with access to all my live trades. Just click on this link to sign up.

As you can see from the chart below, the S&P 500 has since sold off late in the session, after market and early pre-market today.

As it currently stands, the major US index is about 1.5 points below the 380 handle. With this second rally into the resistance level, we’re looking to short again and likely hold till next week.

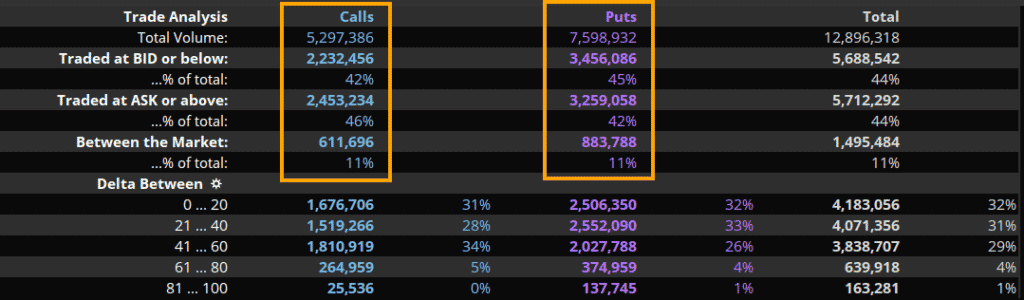

The option flows today were mostly mixed, trading approximately 12.9M options with ~5.3M being calls and 7.6M puts (see below).

The overall flows were positive deltas early on, but shifted to negative deltas at the higher prices. This suggests markets will likely continue to view 380 as resistance, or at least collate around here through the end of the week.

But with the FOMC coming up on the 27th and the VIX expiry on the 20th, we suspect traders will want to hold downside protection through these events, thus gains should remain capped and thus provide opportunities to sell on rallies.