UK and the Pound – 2023 Outlook

This year is expected to be exceptionally challenging for the UK and its economy, with the recovery from the pandemic being overshadowed by a cost of living crisis with low consumer and business confidence, extensive strikes and continuing uncertainty over the war in Ukraine.

UK Inflation soared to 11.1% in 2022. The country had a GDP of -0.3% in Q3 2022 and is expected to have a GDP of -1.0% in Q4 2022 which would be the start of a recession that will likely last through 2023 making the country’s long term growth more complicated. The UK100 moved sideways during the year in a range from 7687.6 (Feb) to 6824.5 (Oct) with business investment and consumer confidence skewed to the downside which is expected to last through 2023.

All indications are that UK growth is set to slow substantially in 2023, with the economy expected to contract significantly and be the weakest of the G20 countries, except Russia. Negative GDP data are expected to continue to fall for the first quarter of the year by -2.2% and to fluctuate between -1.9% and -1.3% until the end of the year. The annual GDP growth rate is forecast to contract to -2.1% by the end of 2023. GDP remains 8% and 27% below its pre-pandemic and pre-financial crisis trend. 10-year government bonds are forecast to rise above 4.6% by 2023.

Inflation reached a 41 year high of 11.1% in October, and is anticipated to react to the tightening cycle by the BoE and fall from the current 10.7% to 7.0% by mid 2023 and to 4.5%-5.00% by the end of 2023, continuing its decline to 2.3% during 2024. Food prices, which have an inflation rate of 16.4% y-o-y currently, are expected to fall rapidly over the next year. The steady rise in base interest rates is forecast to reach up to 5.00% during 2023 in the continuing fight against high inflation to bring it back to the BoE’s target of 2.0%.

Higher interest rates are predicted to produce a decline in housing market activity, by 8.5%, which would reduce the value of collateral available for homeowners to borrow to finance spending. As a consequence of high inflation, the continued rise in mortgage rates and high interest rates, it is clear that living costs have risen significantly affecting real household disposable income which is expected to contract by 2.5% (which would be the largest fall on record) which would directly affect consumer spending which is forecast to fall to -2.1% by 2023. In addition, utility prices are set to rise a further 20% by the second quarter of 2023 when the government’s energy price guarantee for the average annual utility bill ends.

Thanks to the savings during the pandemic, consumers have a cushion for these times; however, consumer confidence is at historic lows making it unlikely that these savings will be used, given the outlook for the future. The tight labour market with labour shortages is expected to become even more complicated thanks to the recession and low demand, with the reduction in hiring and possible job cuts expected to cause the unemployment rate, which currently stands at 3.70%, to start to rise by mid-year to 4.5%-5.0% which would imply a loss of approximately 200k jobs which would continue to rise in 2024. Production is projected to fall by 2% by 2023, below the pre-pandemic trend at the end of 2024.

Low demand, high inflation, rising interest rates, lagging household spending and ongoing geopolitical uncertainties have led to falling business investment in office and transport (3/4 of which is in short supply) giving the possibility of seeing business investment (already 8% below its previous level) fall to -0.7% by 2023 (9% below pre-pandemic levels) given a strong challenge to the government to unlock investment through capital allowances and regulatory changes.

A weaker Pound is likely to help support export growth, and although exports are expected to be affected by weaker demand and overall export volumes are still below pre-pandemic levels, UK exports are forecast to grow by 4.6% in 2023.

In conclusion, the UK is in a very difficult situation for 2023, driven by a recession that has put the country in a difficult economic and business environment to manage, mainly due to the reduction in household spending due to the increase in inflation and the war in Ukraine which also increased energy prices causing a weakness in productivity and investment delaying the country’s recovery from the pandemic, while the uncertainty of a new wave of COVID is also present.

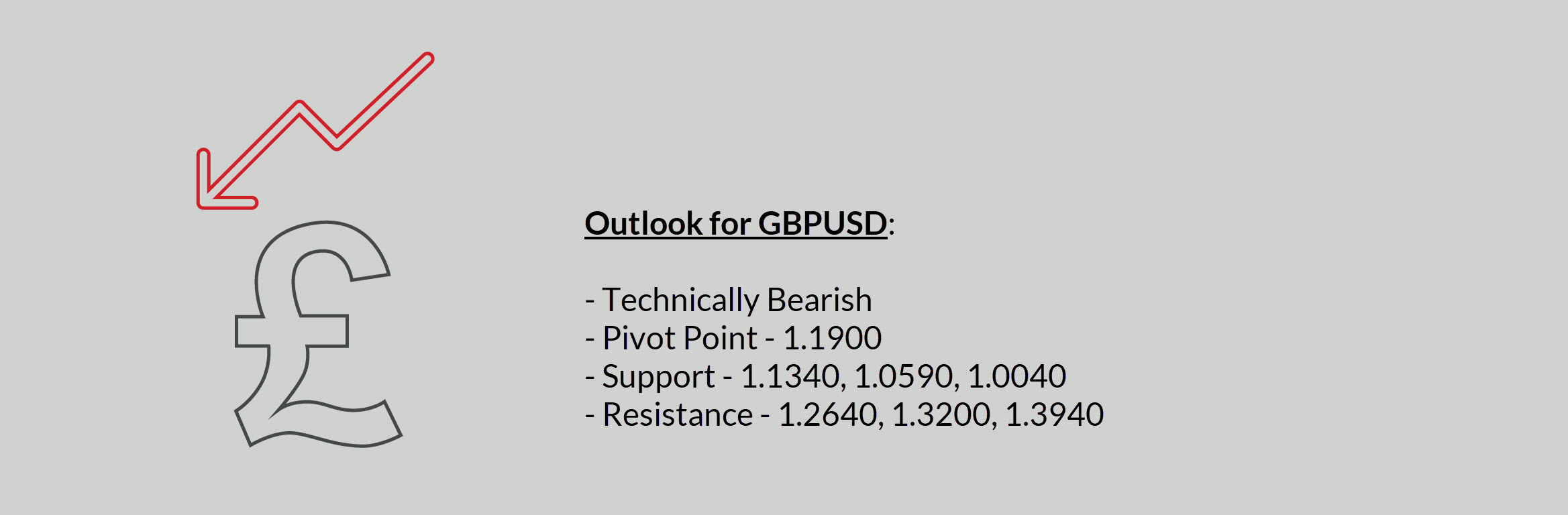

- Sterling weakness could persist into 2023 as the government struggles to manage the recession which is yet to be defined as shallow or deep, short or long lasting, while controlling employment and inflation.

- The economy is expected to contract by -0.4% and have a negative -2% output gap in 2023.

- UK CPI is forecast to remain high at around 7% for most of the year, which will keep the bank committed to its tight monetary policy with continued rate hikes to reach the 2% target.

- The strong monetary policy by the FED is reflected in the strength of the Dollar which supports a continued fall in the pair in contrast to the Pound which is positioned as the second weakest of the major currencies.

Click here to access our Economic Calendar

Aldo W. Zapien.

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.