Japan and the Yen – 2023 Outlook

The Japanese Yen was the weakest currency in 2022 because of the Bank of Japan’s commitment to maintaining a loose monetary policy, effectively widening the Yield differentials with other major economies – particularly the US. The Federal Reserve on the other hand was the most hawkish among the major central banks, hiking interest rates to the upper band of 4.50%. USDJPY rallied as high as 32% in 2022, in mid-October, before pulling back tangibly in the last 2 months of the year as the FED tilted less hawkish, slowing the pace of rate hikes.

Looking ahead into 2023, markets are looking to see if the BOJ will stick to their commitment to pursuing massive monetary stimulus and low interest rates especially after Governor Kuroda assured that he has absolutely no plan to hike rates despite all other major Central Banks hiking rates at a fast pace to curb rising inflation.

In April 2023, Haruhiko Kuroda will step down after his 10-year tenure as Governor of the Bank of Japan and a new Governor will emerge – Deputy Governor Masayoshi Amamiya and former Deputy Governor Hiroshi Nakaso are currently tipped as the forerunners. During his tenure as governor, Kuroda was strongly committed to a massive easing program with low interest rates, citing the joint statement by the BOJ and the Japanese Government in 2013 as justification to try to achieve a stable 2% inflation target.

Investors are now focused on the BOJ’s post-Kuroda policy direction as this change provides an opportunity for the bank to offer fresh perspective, some changes to its monetary policy stance and possibly begin its process towards normalization. Markets see the BOJ’s recently hawkish action – where they allowed the yield on the 10-year Japanese Government Bond to rise to as much as 50 basis points from 25bps to straighten out the distortions in the bond market – as a step in that direction.

The global economy is expected to experience a deep slowdown in 2023 with the IMF projecting global growth to slow to 2.7% this year, down from 3.2% in 2022, and a third of world’s economy – US, EU and China – likely to experience a recession owing to the war in Europe, the effect of COVID-19 restrictions and the higher interest rate environment which has hampered demand. This could provide a tailwind for Japanese Yen as onshore investors look to bring their investments back home, further attracted by the higher yield environment after the BOJ’s recent action which has boosted demand for the local currency.

One of the negative impacts of the Ukraine war on Japan has been a substantial increase in its import bill. Japan imports over 80% of its Oil consumption and the weakness in the Japanese Yen for most of 2022 led to the longest stretch of trade deficit in the country since 2015. The 16-straight months of negative trade balance has seen the Japanese Yen lose some of its safe haven appeal and if this trend continues, downside in Equities as a result of slowing global growth may not necessarily translate into sustained upside for the Japanese Yen.

A top priority for the Japanese Government in 2023 is wage growth which has been very stagnant in recent years, hitting households who are not able to keep up with spending as higher inflation diminishes their spending power. The government plans to achieve this through tax incentives as higher wages will increase spending and as consumption rises, it will eventually lead companies to increase investment. The wage negotiations in Japan, usually around February and March, will be very crucial in 2023 with Rengo, the Japanese Trade Union Confederation, seeking an increase in wages by 5%, including a 3% base pay increase. If achieved, this would improve spending and keep the economy on the recovery path.

Inflation in Japan, just like the rest of the world, is rising, with the core consumer price rising by 3.8% in the month of November, the highest in 40 years. Governor Kuroda pushed back against the expectation that this higher inflation may lead to rate hikes by saying that the recent price increase is driven by a one-off increase in raw material costs rather than strong demand. The Bank of Japan is looking to raise their inflation forecast to show price growth at near the 2% target level for fiscal year 2023 and 2024 and would entertain talk of normalization if it achieves its 2% sustainable price growth coupled with wage hikes – the annual wage negotiation could give us some insights.

The Japanese Government have upgraded their real economic growth forecast to 1.5% for the fiscal year 2023 with the expectation of higher consumer spending on the premise that they achieve higher wages. More onshore investments as higher Yields in Japan and global recession could attract capital back into the country thus supporting further growth. An influx of tourists especially from China as they further lift restrictions could also add to the tailwinds but Japan’s restriction on Chinese travelers poses a threat to this.

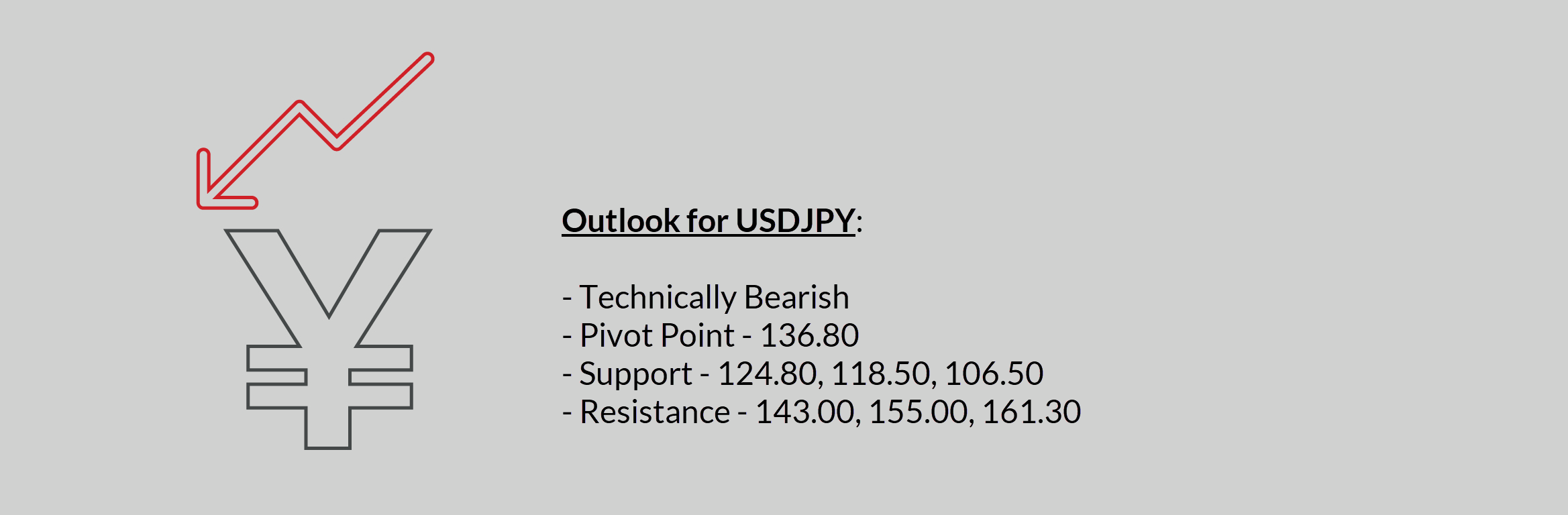

USDJPY Review

- The Japanese Yen could be set to strengthen in 2023 or at least further pare some of the losses from 2022 where it ended as the worst performing major currency despite the solid performance in the last 2 months of the year.

- Higher wages, a more hawkish BOJ under the new leadership, further reopening in China to aid tourism and trade balance thus improving the Yen’s safe haven appeal, a less hawkish FED to avoid a lasting recession, effectively converging the yield curve between the FED and the BOJ would be positive factors for the Japanese Yen in 2023.

- Little to no change in BOJ policy stance, Hawkish FED, Worsening COVID situation in China would serve as headwinds for the Japanese Yen in the year ahead.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.