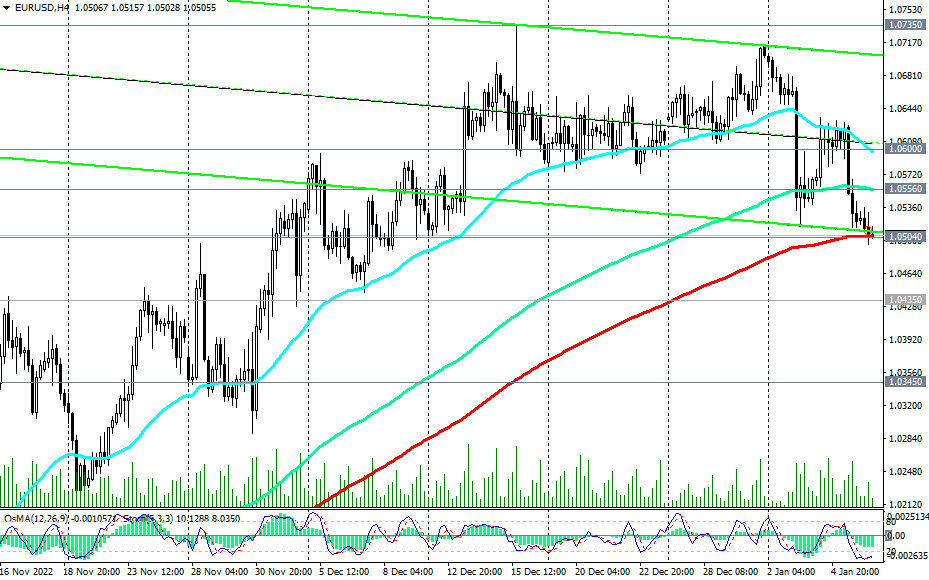

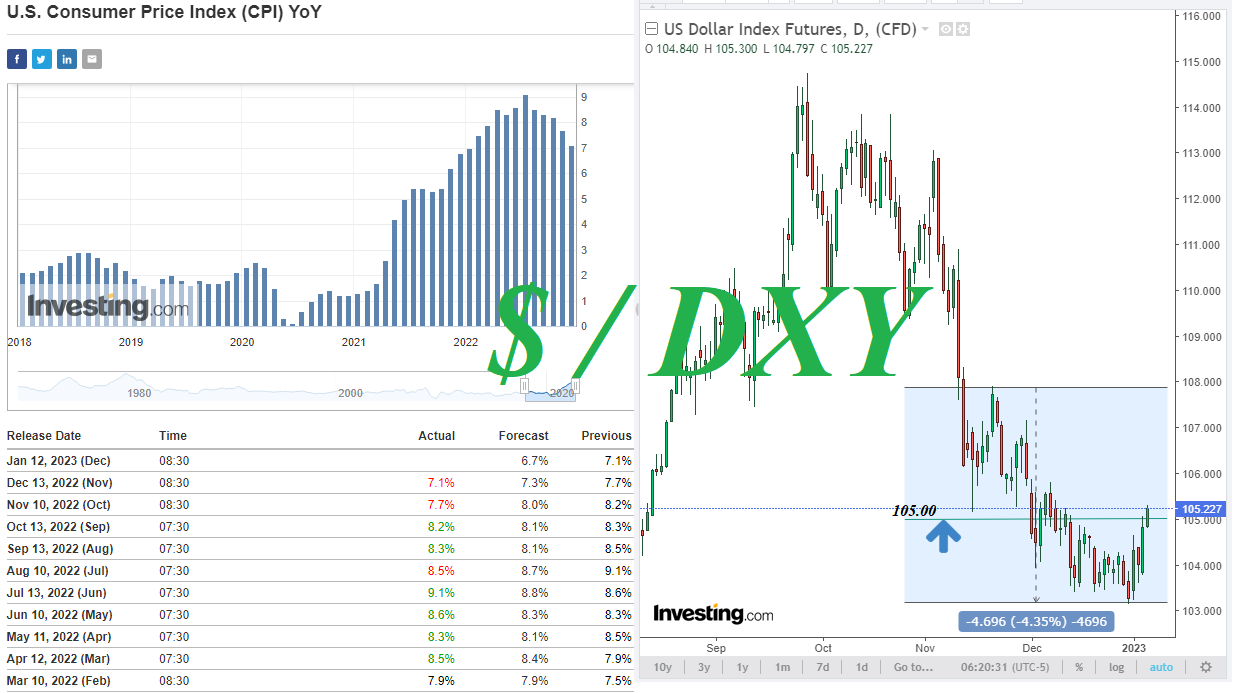

At the time of publication of the article, EUR/USD is testing for a breakdown an important short-term support level 1.0504. Despite the fact that the index of business sentiment in the European economy, which determines the trend of the Eurozone economy as a whole, and core inflation in the Eurozone rose in December (by +0.6% and +5.2% in annual terms), the euro fell immediately after the publication of the Eurostat report. Although core CPI rose, headline inflation in the Eurozone, as measured by the Harmonized Consumer Price Index (HICP), fell to 9.2% (year-on-year) in December (from 10.1% in November), which was also worse market expectations of 9.7%. The slowdown in inflation may contribute to a softer rhetoric of statements and actions of the ECB on the issue of monetary policy, and this is a negative factor for the euro.

In an alternative scenario, the growth of EUR/USD will resume. The breakdown of today’s high at 1.0535 will be the first signal to resume long positions, and the breakdown of the resistance level 1.0556 will be a confirmation. The nearest growth target is the level 1.0600, and the more distant one is the local resistance level and the maximum of December 1.0735.

Nevertheless, from a technical point of view, short positions remain preferable at the moment.

*) for important events of the week, see the Most Important Economic Events of the Week 01/02/2023 – 01/08/2023, and for the upcoming week – see the Most Important Economic Events of the Week 01/09/2023 – 01/15/2023

Support levels: 1.0504, 1.0435, 1.0400, 1.0345, 1.0300, 1.0190, 1.0000, 0.9745, 0.9700, 0.9600, 0.9550, 0.9500

Resistance levels: 1.0535, 1.0556, 1.0600, 1.0700, 1.0735