The dollar is totally weakening. The US inflation data published yesterday strengthened the opinion of market participants that the Fed will continue to reduce the pace of interest rate hikes, and at the meeting on January 31 – February 1, it will raise the rate by only 0.25% (after increasing by 0.50% in December and by 0 .75% months earlier), and then slow down the pace of tightening its policy even more and possibly ease it in the near future.

Although US GDP grew in the 3rd quarter by 3.2% (on an annualized basis), stopping the so-called “technical recession” or decline for 2 quarters in a row, data on certain critical sectors of the US economy indicate its slowdown, being under pressure from a tough Fed policy.

As a result of the outgoing week, the dollar weakened, and its DXY index fell by more than 1.5%. At the time of writing this article, DXY futures were trading near 101.90, 175 pips below the previous week’s close, moving inexorably towards the psychological 100.00 mark.

In the meantime, and as we noted in our Fundamental Analysis today, dollar buyers are likely to get some breathing room today if profit-taking on short positions in dollar begins amid the release (at 15:00 GMT) of the provisional Michigan Consumer Confidence Index.

In fact, it looks like it has already begun. Despite the fall at the very beginning of today’s European session, during its course and, literally at the time of publication of the article, the dollar is strengthening, and the EUR/USD pair, respectively, is declining.

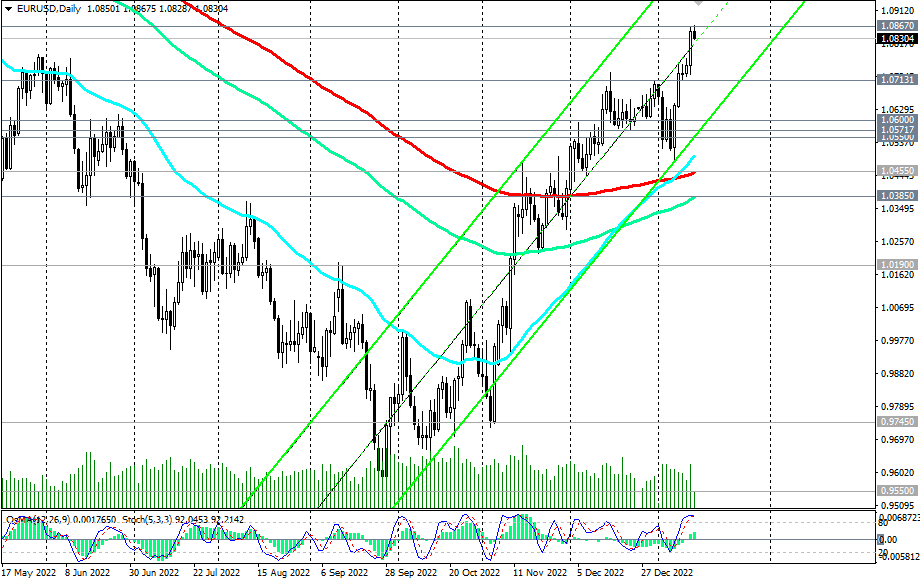

So far, we expect 2 targets of this decline – the support level of 1.0802 and 1.0713, if there is no rebound from the support level of 1.0802 and the resumption of growth.

A breakdown of the support level 1.0713 may provoke a further decline to the zone of strong support levels 1.0600, 1.0572, 1.0550.

Support levels: 1.0802, 1.0713, 1.0600, 1.0572, 1.0550, 1.0500, 1.0455, 1.0370, 1.0190

Resistance levels: 1.0867, 1.0900, 1.1000, 1.1130

• See details -> https://www.instaforex.com/ru/forex_analysis/332268/?x=PKEZZ

• see also “Technical analysis and trading scenarios” -> https://t.me/fxrealtrading

• For important events of the next week, see the Most Important Economic Events of the Week 01/16/2023 – 01/22/2023 – https://www.instaforex.com/ru/forex_analysis/332256/?x=PKEZZ