A strong bullish engulfing timeframe appeared on the UBI stock chart on the daily timeframe. This rise translated to a 15% rise in price from an opening price of €34.

Source: Error 420

This rise resulted from rumors of a takeover by buyout funds. While no official statement has been released, that didn’t stop the stock from soaring in response. Many investors believe this buyout is significant for Ubisoft Entertainment SA (EURONEXT: UBI), as the Assassins Creed maker has suffered dwindling popularity among gamers in recent years.

But are these rumors enough to drive the Ubisoft stock out of its relentless downtrend? And does this discount present a good buying opportunity for Ubisoft stock?

Let’s see what the chart holds for the stock.

Support And Resistance

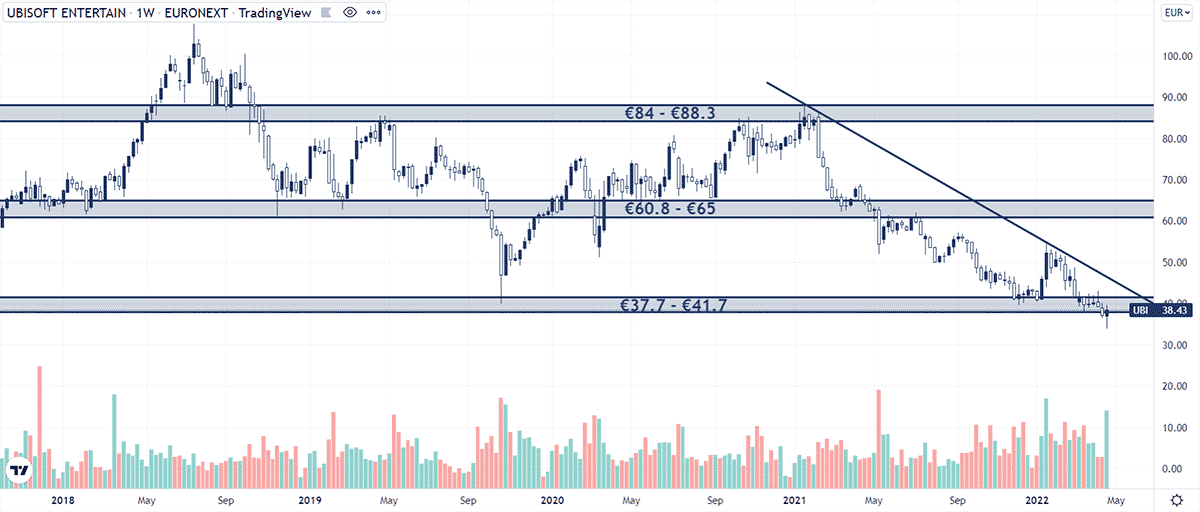

Ubisoft stock has suffered from the bears lately. The stock has dropped by 56% since a peak in January 2021 and has not recovered since then.

During this meteoric fall, the price bulldozed through the €60.8 – €65 support level and is now getting to work on the €37.7 – €41.7 level. Moreso, that dip has kept UBI stock below a bearish trendline.

However, if the stock is going to rise, it may need to also break out of the resistance level at the €51.5 price.

Signals And Forecasts

That the stock is below the bearish trendline is not a good signal for the shareholders of UBI. The stock broke below its lowest level since 2017 this March, and the bears don’t seem to be done with the stock.

Unless the stock breaks out of the bearish trendline, there isn’t much to suggest a break to Ubisoft’s downfall.

Should You Buy Ubisoft Stock Now?

Do not buy Ubisoft stock yet. Despite its 15% rise in a single day, the stock still has too many factors going against it:

- It is on a downtrend.

- It looks to have fallen below the €37.7 – €41.7 support level.

We recommend you at least wait for a breakout of the bearish trendline before you consider buying Ubisoft stock.