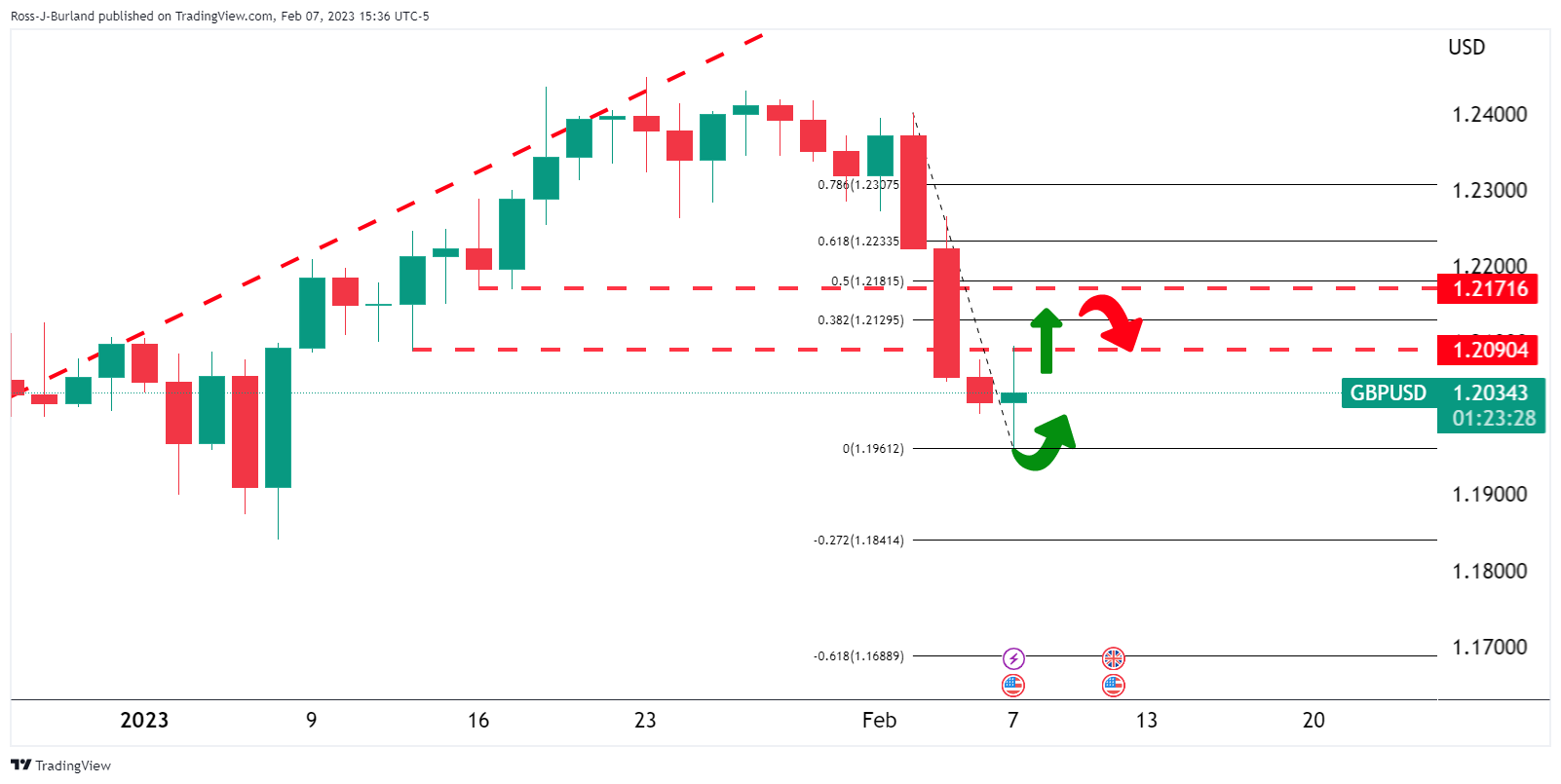

- GBP/USD is setting the foundations for a bullish setup with the 1.2180s eyed in a 50% mean reversion target.

- A 38.2% Fibonacci retracement is located at 1.2195.

- Nevertheless, bears will be lurking considering the break of structure at 1.2090.

GBP/USD bulls moved in on Tuesday and are setting the foundations for a bullish correction of the recent slide from the 1.23s at the start of February. The following illustrates the bullish bias for the day ahead.

GBP/USD M15 chart

The price has rallied from a low of 1.1960 to a high of 1.2095, taking out Monday’s high, MH, and breaking structures, BoS, along the way, The price has also moved to the backside of the prior bearish dynamic resistance, (bearish trendline), that would now be expected to act as a counter-trendline.

The breakout of these structures leaves the directional bias in favour of a meanwhile bullish correction on the daily chart for the day ahead, pending a bullish close on Tuesday:

Zoomed in …

This leaves the foundations of a long trade for whichever session traders are in, looking for a bullish setup with the 1.2180s eyed in a 50% mean reversion target. On the way there, a 38.2% Fibonacci retracement is located at 1.2195. Nevertheless, bears will be lurking considering the break of structure at 1.2090.