Most traders are guilty of being perfectionists. Traders are always on the look out for the best indicators and the best trading strategies in the effort of constantly improving their trading performance. However, perfection is impossible to attain if forex trading. This is because trading statistics is always a result of probabilities. There would be some wins and some losses. Although perfection should not be the goal, this habit of continually improving should lead traders to trade setups with the best opportunities.

One of the best opportunities in the forex market often occur during price extremes. This is because market sentiment is often like a pendulum. Traders would often dive in on extreme price swings as this could mean a deep discount for savvy traders. Traders often quickly buy forex pairs that are oversold and sell pairs that are overbought. This behavior often push price to the opposite direction which could then result in a new trend being formed.

Trend reversals are often seen just as a simple trend reversal. However, if you would examine trend reversals closely, you would notice that trend reversals often begin as a shift in market sentiment coming from an overbought or oversold condition. Traders could either trade as the trend reversal is confirmed or trade as the market begins to reverse from an overbought or oversold condition.

Bollinger Bands

The Bollinger Bands is a unique technical indicator because it provides traders vital information using just a single technical indicator. It provides information regarding trend, volatility, momentum and overbought or oversold prices.

The Bollinger Bands is composed of three lines. The middle line is preset as a 20-period Simple Moving Average (SMA). Traders can use this line to help them identify trend direction based on the location of price action in relation to the line, as well as the slope of the line. Trend reversal triggers can also be identified based on the crossing over of price action and the middle line.

The outer lines are standard deviations based on the middle line. It is usually preset at +/-2 standard deviations. This line can be used to identify volatility, momentum and overbought or oversold prices.

Traders can identify volatility based on the contraction and expansion of the outer lines. Contracting lines indicate low volatility, while expanding lines indicate high volatility.

The outer lines can also be used to identify momentum breakouts. Strong momentum candles breaking outside of the band could indicate a momentum breakout.

On the other hand, the same lines can also be used to identify reversals from an overbought or oversold market. Price action showing signs of price rejection pushing against the outer lines indicate a probable mean reversal coming from an overbought or oversold price.

BB Alert Arrows

The BB Alert Arrows is a custom technical indicator which is based on the Bollinger Bands.

As discussed earlier, the Bollinger Bands can be used to identify mean reversals. The BB Alert Arrows simplify the process of identifying probable mean reversals by plotting arrows indicating such possible conditions.

An arrow pointing up indicate a bullish mean reversal which can be caused by an oversold market price. On the other hand, an arrow pointing down indicate a bearish mean reversal which can be caused by an overbought market price.

Traders can use these arrows as a mean reversal entry signal.

BB Win

BB Win is another custom technical indicator which is based on the Bollinger Bands. It is also a part of the oscillator family of indicators.

This indicator simply transposes the Bollinger Bands into an oscillator plotted on a separate window. The difference is that it has its midline fixed at zero, which is based on a moving average.

Volatility can also be identified based on the expansion and contraction of the lines.

Another moving average line is plotted by the indicator which is based on a moving average line. Trend reversal signals can be identified based on the crossing over of the line from positive to negative or vice versa.

Trading Strategy

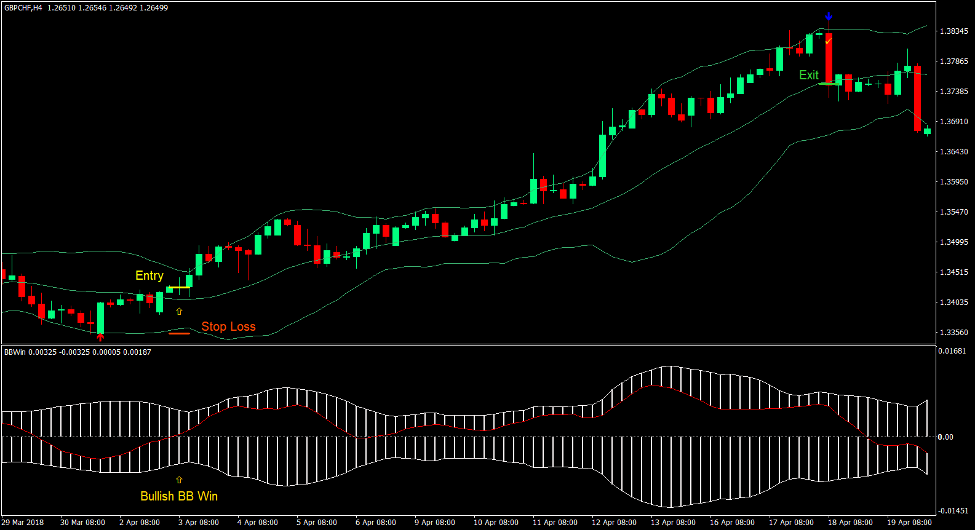

Bollinger Bands Big Win Forex Trading Strategy aims to capture huge trend reversals that begin from a mean reversal coming from an overbought or oversold price condition.

Overbought or oversold price conditions are identified based on price touching the outer lines. However, mean reversal signals are confirmed using the BB Alert Arrows indicator. Arrows plotted while price action is rejecting the outer lines is confirmed as a mean reversal signal.

Trend reversals are then confirmed based on the crossing over of the red line of the BB Win indicator, from positive to negative or vice versa.

Indicators:

- Bollinger Bands

- BBalert_Arrows

- BBWin

Preferred Time Frames: 1-hour, 4-hour and daily charts

Currency Pairs: FX majors, minors and crosses

Trading Sessions: Tokyo, London and New York sessions

Buy Trade Setup

Entry

- The BB Alert Arrows indicator should plot an arrow pointing up while price action is showing signs of price rejection pushing against the lower Bollinger Band.

- The red line of the BB Win indicator should cross above zero.

- Enter a buy order on the confirmation of these conditions.

Stop Loss

- Set the stop loss on the support below the entry candle.

Exit

- Close the trade as soon as the BB Alert Arrows plot an arrow pointing down.

Sell Trade Setup

Entry

- The BB Alert Arrows indicator should plot an arrow pointing down while price action is showing signs of price rejection pushing against the upper Bollinger Band.

- The red line of the BB Win indicator should cross below zero.

- Enter a sell order on the confirmation of these conditions.

Stop Loss

- Set the stop loss on the resistance above the entry candle.

Exit

- Close the trade as soon as the BB Alert Arrows plot an arrow pointing up.

Conclusion

Trend reversal strategies that begin from an overbought or oversold price condition using Bollinger Bands is a staple strategy used by many profitable forex traders. This often requires traders to have a good understanding of price action, price candle patterns and the like.

However, this might not come easy to new forex traders. The use of supplementary technical indicators such as the BB Alert Arrows and BB Win indicator simplifies the process. Traders can begin from this and develop to a full-blown price action and Bollinger Band based traders as their skills improve.

Forex Trading Strategies Installation Instructions

Bollinger Bands Big Win Forex Trading Strategy is a combination of Metatrader 4 (MT4) indicator(s) and template.

The essence of this forex strategy is to transform the accumulated history data and trading signals.

Bollinger Bands Big Win Forex Trading Strategy provides an opportunity to detect various peculiarities and patterns in price dynamics which are invisible to the naked eye.

Based on this information, traders can assume further price movement and adjust this strategy accordingly.

Recommended Forex MetaTrader 4 Trading Platform

- Free $50 To Start Trading Instantly! (Withdrawable Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Claim Your $50 Bonus Here <<

Click Here for Step-By-Step XM Broker Account Opening Guide

How to install Bollinger Bands Big Win Forex Trading Strategy?

- Download Bollinger Bands Big Win Forex Trading Strategy.zip

- *Copy mq4 and ex4 files to your Metatrader Directory / experts / indicators /

- Copy tpl file (Template) to your Metatrader Directory / templates /

- Start or restart your Metatrader Client

- Select Chart and Timeframe where you want to test your forex strategy

- Right click on your trading chart and hover on “Template”

- Move right to select Bollinger Bands Big Win Forex Trading Strategy

- You will see Bollinger Bands Big Win Forex Trading Strategy is available on your Chart

*Note: Not all forex strategies come with mq4/ex4 files. Some templates are already integrated with the MT4 Indicators from the MetaTrader Platform.

Click here below to download: